Now Reading: How to Create a Crypto Wallet in 2025 – Proven Guide to Stay Safe & In Control

-

01

How to Create a Crypto Wallet in 2025 – Proven Guide to Stay Safe & In Control

How to Create a Crypto Wallet in 2025 – Proven Guide to Stay Safe & In Control

If you’re wondering how do I create a crypto wallet, this guide walks you through every step and keep your digital coins secure? You’ve come to the right place! In this 2025 step-by-step guide, we’ll walk you through how to create a crypto wallet, how to create a wallet address, and most importantly, how to stay safe while using it. We’ll cover everything in a friendly, beginner-friendly tone – from setting up your first wallet address to answering common safety questions like “is Coinbase Wallet safe?”, “is Exodus wallet safe?”, “is Trust Wallet safe from hackers?”, and even how to cash out from Coinbase when you’re ready. By the end, you’ll have all the know-how to manage your crypto confidently and securely.

Introduction: Crypto Wallets 101

What exactly is a crypto wallet? In simple terms, a crypto wallet is like your personal banking tool for cryptocurrencies. It allows you to store, send, and receive digital assets like Bitcoin or Ethereum. Unlike a physical wallet that holds paper cash, a crypto wallet doesn’t actually “hold” your coins on a device. Instead, it stores your private keys – secure codes that give you access to your crypto on the blockchain. These keys prove that you own the funds linked to a specific wallet address (think of a wallet address like your bank account number on the blockchain).

👉 Why do you need a crypto wallet? If you want to buy, trade, or HODL crypto, you’ll need a wallet to manage those assets. It’s the first step before you can truly control your coins. According to crypto experts, “the first step required to be able to buy and sell cryptocurrencies is to create a crypto wallet”investopedia.com. Having your own wallet means you’re in control of your money, rather than leaving it with an exchange or platform. In 2025, with crypto becoming more mainstream than ever, learning how to create a crypto wallet is an essential skill for beginners and seasoned investors alike.

Security is key: We’ll also emphasize how to stay safe while using your crypto wallet. The crypto world can be risky if you’re not careful – there are hackers, scams, and simple user mistakes that can lead to lost funds. Don’t worry, we’ll cover practical safety tips to keep your wallet secure (and yes, we’ll answer “is Coinbase wallet safe?” and “is Trust Wallet safe from hackers?” in detail!). By following best practices, you can confidently manage your coins without losing sleep. (Fun fact: Even the biggest crypto companies reinforce safety. For example, Coinbase reminds users that they will never ask for your password or 2FA codes, and to enable features like address allow-listing for extra security – more on these later.)

Before we dive into the how-to steps, let’s briefly look at the different types of wallets you can choose from in 2025, so you can decide what’s best for you.

Types of Crypto Wallets (2025 Overview)

Not all crypto wallets are the same. In 2025, you have a variety of wallet types available, each with its pros and cons. Understanding the differences will help you choose a platform you trust and that meets your needs. Here’s a quick overview:

- Software Wallets (Hot Wallets): These are apps or programs on your phone or computer. They’re called “hot” because they are typically connected to the internet. Examples include Coinbase Wallet, Exodus, Trust Wallet, Mycelium, and many others. They are usually free and easy to set up in minutes. Software wallets are great for beginners due to their convenience and user-friendly interfaces. However, since they run on internet-connected devices, you need to be mindful of malware or hackers. We’ll discuss is the Coinbase wallet safe and similar questions in the safety section – generally, hot wallets are safe if you follow security best practices, but they are not as airtight as cold storage.

- Hardware Wallets (Cold Wallets): These are physical devices (like a USB stick or smartcard) that store your crypto offline. Famous examples are Ledger (e.g., Ledger Nano X) and Trezor (e.g., Trezor Model T), as well as newer options like Arculus (a key-card style wallet). Hardware wallets keep your private keys in a secure chip offline, making them immune to online hacking attempts. They are widely considered the safest way to store crypto – even if your computer is infected with malware, a hardware wallet keeps your keys isolated. The downside? They cost money (typically $50-$150) and you need to keep the device safe from loss or damage. For long-term investors or those holding larger amounts, a hardware wallet is highly recommended for peace of mind. (We’ll mention Ledger and Trezor again when talking security, since using a hardware wallet is one of the top ways to “stay safe” with crypto.)

- Exchange or Custodial Wallets: If you’ve created an account on a crypto exchange like Coinbase, Binance, or Robinhood, you technically already have a “wallet” provided by that company – but it’s a custodial wallet. This means the exchange holds your private keys on your behalf. It’s convenient (you just log in to your account and don’t have to manage keys or seed phrases), but it’s kind of like a bank – you have to trust the platform’s security. While big exchanges have strong security teams and often insure assets, history has shown that hacks or freezes can happen. The saying in crypto goes: “Not your keys, not your coins.” So, many crypto users prefer to withdraw their coins from exchanges into their own software or hardware wallet, where they control the keys. In this guide, we’ll focus on creating your own wallet (non-custodial), but we’ll also explain how to cash out from Coinbase and similar platforms securely when you need to.

- Paper Wallets: These are somewhat old-school now, but you might hear the term. A paper wallet is literally a document (paper) with a printed public address and private key, often as QR codes. This is a form of cold storage since it’s completely offline. However, paper wallets can be tricky to use (you have to manually enter or scan keys) and if you lose that paper or it gets damaged, your funds are gone. In 2025, most beginners can skip paper wallets in favor of hardware devices or secure software wallets with backups.

- Mobile vs. Desktop vs. Web Wallets: Software wallets can come in different forms – mobile apps (e.g., Trust Wallet on your phone), desktop programs (Exodus has a PC app), or browser-based wallets (like a browser extension or web login). Mobile wallets are handy for everyday use and on-the-go payments. Desktop wallets may offer more features or a bigger interface. Web wallets (including some exchange wallets) let you access via browser. Just remember: if it’s connected to the internet, treat it as a hot wallet and secure your device accordingly.

Now that you know the types, let’s get into the actual steps of how to create a crypto wallet for yourself. Don’t worry – it’s easier than it sounds, and you don’t need to be a tech wizard. We’ll also point out where you should be extra cautious to stay safe during the setup.

How Do I Create a Crypto Wallet? (Step-by-Step Guide)

Ready to set up your first crypto wallet? Here’s a step-by-step guide that works for most wallets. We’ll assume you’re creating a software wallet (the process for a hardware wallet is slightly different and we’ll mention that too). These steps will cover everything from installation to getting your wallet address and securing your wallet. Let’s get started!

Step 1: Choose the Right Wallet Type

The first step is to select a reliable wallet provider that fits your needs. Ask yourself a few questions: Do you primarily need a mobile wallet or a desktop wallet? Do you plan to hold a variety of cryptocurrencies or just Bitcoin? Are you willing to buy a hardware device for extra security, or do you prefer a free app?

- For beginners, a trusted software wallet like Coinbase Wallet, Exodus, or Trust Wallet is a great starting point. These support multiple coins and have friendly interfaces. For example, Exodus supports hundreds of assets and is known for its attractive design, while Trust Wallet (official wallet of Binance) is open-source and widely used for mobile. Coinbase Wallet is another popular choice – note that this is different from the Coinbase exchange app; Coinbase Wallet is a separate app where you control the keys.

- If you are focused on Bitcoin only, you might consider a Bitcoin-specific wallet like Mycelium (a long-standing mobile Bitcoin wallet) or Electrum (a desktop Bitcoin wallet). Mycelium is quite secure and has been around since 2008, catering to Bitcoin enthusiasts.

- If security is your top priority and you don’t mind spending some money, consider a hardware wallet like Ledger or Trezor. These devices pair with companion software. For instance, Ledger has the Ledger Live app, and Trezor works with Trezor Suite or third-party wallets. Hardware wallets add an extra step in usage (you’ll connect the device whenever you need to sign a transaction), but they drastically reduce the risk of online hacks.

Take a moment to research your chosen wallet’s reputation. In 2025, Coinbase Wallet is generally considered one of the safest hot wallets (it has features like transaction previews and biometric locks), and Exodus is praised for ease-of-use. Trust Wallet is backed by Binance and open-source. All are good choices – the key is to download the official app (more on that next). Check that the wallet supports the cryptocurrencies you plan to use. Also, ensure it’s available on your device (e.g., iOS, Android, Windows, etc.).

👉 Pro Tip: Be wary of fake wallets! Only download wallet apps from official sources (the official website or app store). Unfortunately, scammers have created lookalike apps to trick users. Always double-check the developer name and reviews. For example, if you search app stores for “Trust Wallet,” make sure the publisher is “Trust Wallet, Inc.” and not a random name.

Step 2: Download or Set Up Your Wallet

Once you’ve chosen a wallet, it’s time to install it:

- For software wallets (mobile or desktop): Go to the official site or app store link and download the app. For instance, to get Exodus, you’d go to Exodus.com or your phone’s App Store/Google Play and install Exodus. To get Coinbase Wallet, find the app named “Coinbase Wallet” (distinct from the regular Coinbase app). Trust Wallet can be found similarly. The download is usually quick. After installing, open the app.

- For hardware wallets: If you bought a Ledger or Trezor, follow the instructions in the box. Typically, you’ll need to connect the device to your computer or phone and then download the companion software (e.g., Ledger Live app or Trezor Suite). The device will guide you through initial setup on its little screen in tandem with the software. Make sure any hardware wallet you purchase is brand new from a reputable source – never use a pre-owned hardware wallet or one that has had its package tampered with, for safety.

With the wallet app open or device ready, you’ll usually see an option like “Create New Wallet” or “Get Started.” Go ahead and click that. You might be prompted to accept Terms of Service – feel free to skim those, but it’s standard stuff.

Important: Most non-custodial wallets (like Exodus, Trust, Coinbase Wallet, etc.) do NOT require any personal information to create a wallet. You won’t have to enter an email, name, or ID. This is normal – your wallet is just generated locally on your device. If a wallet app is asking for a lot of personal info up front, double-check that you’re not accidentally on an exchange signup instead of a wallet creation. (Some wallets might offer to create an optional cloud backup account – you can skip that for now to keep things simple.)

Step 3: Securely Back Up Your Recovery Phrase

This is the most critical step when creating a crypto wallet. As soon as you create a new wallet, the app will generate a recovery phrase (also known as a seed phrase or mnemonic phrase). This is typically a sequence of 12 or 24 random words. For example, you might see a list of words like: “board, rocket, battery, horse, staple, …” (up to 12/24 words). These words are the master key to your wallet.

Your wallet will likely display the recovery phrase and instruct you to write it down. Do not skip this! Grab a pen and paper and carefully copy each word in order. Double-check the spelling. Most wallet apps will then make you confirm a couple of the words (to ensure you wrote them correctly) by asking you to tap them in the right order. Do so carefully.

Why is this recovery phrase so important? Because if you ever lose access to your device or the app (say your phone breaks or you accidentally delete the wallet), the only way to recover your funds is by entering that 12- or 24-word phrase into a new wallet. It basically can recreate your wallet on any compatible app. On the flip side, anyone who gets your recovery phrase can steal all your crypto – it’s as powerful as having your passwords, PINs, everything. So you must guard those words with your life.

🔒 Safety Tips for Recovery Phrases: Store your written copy of the phrase in a secure, private place. Good ideas include a safe, a locked drawer, or even splitting it into parts and keeping in two secure locations (just be very careful with that). Do NOT take a screenshot of it or save it in a file on your computer/phone. Online storage is vulnerable to hackers. Keeping it strictly offline (on paper or engraved in metal for extra durability) is the best. Many crypto veterans use metal backup tools (like metal plates) to record their seed phrase because they’re fire and water-proof – something to consider if you’re holding a lot of value. But as a beginner, a piece of paper (or two) in safe spots works.

Never share your seed phrase with anyone. No legitimate support or company will ever ask for those words. Scammers often pretend to be “support” and ask for the phrase – that’s a huge red flag. Remember: anyone with that phrase can access your wallet. If you suspect someone saw or stole your phrase, you should immediately create a new wallet and transfer your funds to it (with a new secure phrase), because the old one is compromised.

(Internal Tip: We recently published a Brainstak article on “How to Extract Text from an Image”. But do not use image-to-text tools on your recovery phrase – it should never touch any digital device or cloud service! Keep it strictly analog to stay safe.)

Step 4: Add Security Measures (PIN, Password, 2FA)

After backing up the seed phrase, your wallet itself will usually prompt you to set some security within the app:

- App Password or PIN: Most mobile wallets let you set a PIN code or password to open the app. For example, Trust Wallet will ask you to set a 6-digit PIN. Exodus might prompt you to set a password for the wallet (which encrypts your private keys on your device). Choose a strong PIN/password that isn’t easily guessable. This step is important because it provides a first line of defense – if someone physically gets into your phone or computer, they can’t open the wallet app without that PIN/password. Use something you won’t forget, but also not something obvious like 1234 or your birthday.

- Biometric lock: Many wallets support biometric security like fingerprint or Face ID unlock (usually it’s an option linked to the PIN). Enabling this can add convenience and a bit of extra safety (since only your fingerprint/face can unlock in theory), though you should still have a strong PIN as fallback.

- Two-Factor Authentication (2FA): Some wallet apps (especially those tied to services, or exchange wallets) might allow 2FA. For non-custodial wallets, 2FA isn’t commonly a built-in feature (because transactions are authorized by your keys anyway). However, if you use a Coinbase account (custodial) or Robinhood, definitely enable 2FA on your account settings. In the context of purely self-custody wallets, your “2FA” is basically the fact that transactions require your private key (or hardware device). But as a user, you can simulate an extra factor by, say, requiring a password to open the wallet and another to send transactions (some wallets like MetaMask allow a password prompt on each send).

- Hardware wallet pairing: If you are using Exodus or another software that can connect to hardware wallets, take advantage of that for big balances. For example, Exodus lets you use a Trezor hardware wallet for enhanced security – the software remains easy to use, but all send-outs require the Trezor device confirmation. This way, even if your computer is hacked, thieves can’t send funds without that physical device. This might be something to explore down the road, but good to know.

After setting up these security layers, your wallet is basically created and secured. Congrats! You’re almost ready to use it.

Step 5: Create a Wallet Address & Start Using Your Wallet

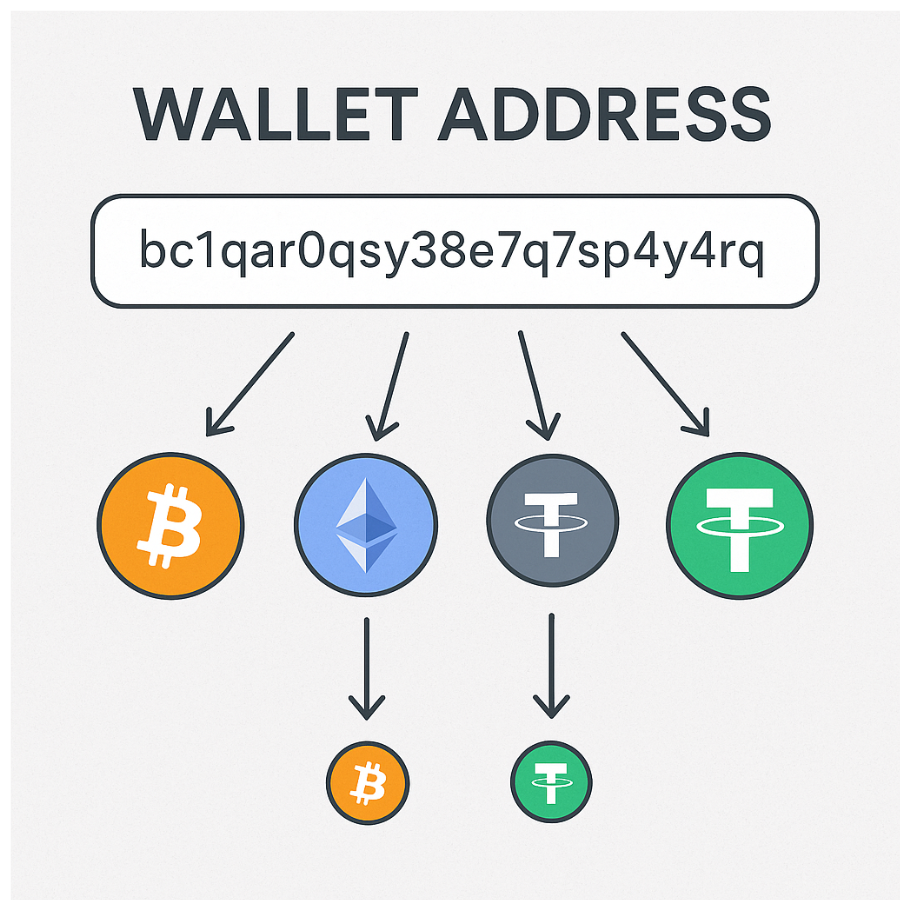

Now that your wallet is set up and secured, you’ll want to get your wallet address so you can receive crypto. The good news is that when you created the wallet, it automatically generated wallet addresses for you (at least one for each cryptocurrency it supports). You typically don’t have to “create a wallet address” separately – it’s a byproduct of creating the wallet.

However, accessing and using that address is the key final step:

- Find your receiving address: In your wallet app, look for a “Receive” button or tab. It might be on the main screen or in a menu. For instance, in Trust Wallet you would tap on the cryptocurrency (say Bitcoin) and then tap “Receive” to get your Bitcoin wallet address. In Exodus, there’s a dedicated receive section for each asset. Coinbase Wallet app similarly has a receive function. Tapping “Receive” will display your wallet address – usually as a long string of letters and numbers, and also as a QR code that someone can scan. This is the address others will use to send you crypto. You can copy it to your clipboard from the app.

- Understanding wallet addresses: Each cryptocurrency has its own address format. A Bitcoin address looks different from an Ethereum address, for example. Make sure you use the correct address for the right coin. If you want someone to send you ETH (Ethereum), get your Ethereum address from your wallet’s receive section – don’t accidentally give them a Bitcoin address. Many modern wallets manage multiple coins under the hood, and will clearly label the address you’re viewing (e.g., it might say “Your Ethereum address”). If unsure, look at the prefix: Ethereum addresses typically start with

0x, Bitcoin addresses may start with1,3, orbc1… and so on. The wallet app will handle this; just be cautious to copy the right one. - Creating new addresses (optional): Some wallets (especially for Bitcoin and other UTXO coins) can generate a new address each time for privacy. This is part of being a “HD (Hierarchical Deterministic) wallet” – a fancy term meaning from your one seed phrase, it can create many addresses. For beginners, you can reuse your one address for simplicity, but just know you have the ability to generate fresh addresses if needed. For example, Mycelium and Electrum allow creating multiple addresses. This can help keep your balances more private on the blockchain. But it’s fine to start with one address per coin.

- Send a test transaction: If you already have some crypto (maybe on an exchange or another wallet), now is a good time to test out your new wallet by sending a small amount to that receive address. For instance, you could send a few dollars worth of crypto from your Coinbase account to your new wallet address. This lets you verify everything is working and that you saved the keys properly. Always do a small test before moving large funds. When the crypto arrives (which might take a few minutes or more, depending on the network), you’ll see it in your wallet balance. Congratulations – you’ve created a crypto wallet address and received crypto in it!

Your crypto wallet is now up and running. You can send coins by clicking “Send” in the app, entering someone else’s address and the amount. (When sending, always double-check the address you paste – it should match the recipient exactly. A common safety tip is to verify at least the first 4-5 characters and last 4-5 characters of the address to ensure there’s no copy-paste malware messing with it.)

We’ve successfully covered how to create a wallet address as part of the setup. But if you still have that question “how to create a wallet address” in mind, the next section summarizes it one more time in a straightforward way.

How to Create a Wallet Address

Before you get started, many users ask: how do I create a crypto wallet that generates a safe and private address? You might be specifically searching for how to create a wallet address – perhaps you just need an address to receive some crypto a friend wants to send you. Here’s the quick answer:

To create a wallet address, you first create a crypto wallet using a wallet app, and the address is generated for you automatically. There isn’t a way to get an address by itself without a wallet; the address is an integral part of the wallet.

Steps to get a wallet address:

- Set up a wallet (follow the steps above with your chosen app or device).

- Open the Receive menu in the wallet and select the cryptocurrency you need an address for.

- The app will display your public wallet address (often with a QR code). For example, it might show something like:

0xAB3...EF56for Ethereum orbc1q...xyzfor Bitcoin. - Copy that address and share it with whoever needs to send you crypto. Or use the QR code for them to scan if you’re in person.

That’s it! The act of creating the wallet (and backing up your keys) is what creates the address. If you ever need a new address (for privacy or organizational reasons), most wallets let you generate a new one in the receive menu (it will still be linked to your same wallet/seed phrase). Always ensure you’re giving out the correct address for the correct coin.

Reminder: Never confuse your public wallet address with your private key/recovery phrase. The address is meant to be shared (it’s public-facing, like your crypto email address so people can send you funds). The private keys or seed phrase, however, stay secret. When someone asks for your address, give the long public address string – never give out the 12-word seed or any private key.

Now that you have your wallet and addresses set up, let’s move on to the crucial part: staying safe. After all, what’s the point of creating a crypto wallet if you’re not going to protect it? The next section outlines how to keep your wallet secure in 2025’s threat landscape.

Staying Safe with Your Crypto Wallet

Knowing how do I create a crypto wallet is one thing but securing it for the long haul is where it really counts.

Security is a huge part of using crypto. By taking control of your own wallet, you’re also taking on the responsibility of protecting your funds. The good news? With a few smart practices, you can reduce risk dramatically and sleep soundly knowing your assets are safe. Let’s break down the essential crypto wallet safety tips.

1. Keep Your Recovery Phrase Offline and Secret: We can’t stress this enough (that’s why we dedicated Step 3 to it). The number one cause of people losing their funds is by exposing the seed phrase or private keys. Whether it’s via phishing websites, malware, or simply someone finding their written note, that phrase is the holy grail. So, store it offline in a secure place. Never enter it on random websites or share it. Scammers often ask something like “verify your wallet by entering your 12-word phrase” – that’s always a scam. If you suspect any leak, move funds to a new wallet immediately.

2. Use Hardware Wallets for Large Amounts: For amounts that you can’t afford to lose, consider upgrading to a hardware wallet. Devices like Ledger and Trezor add an extra layer of protection. Even if your computer has a virus, the hacker would still need your physical device (and usually your PIN) to confirm a transaction. In 2025, hardware wallets remain the gold standard for security. Newcomer Arculus (a hardware wallet in the form of a metal card with 3-factor authentication) is also an interesting option – it uses something you have (the card), something you know (a PIN), and something you are (biometric on your phone) to unlock. These multiple factors make it extremely tough for hackers to break in. If you have significant crypto holdings, it’s worth the investment in a hardware wallet.

3. Secure Your Devices: Your wallet’s security is as strong as the device it’s on. If you use a phone for a mobile wallet, keep that phone secure! Use a strong passcode, enable biometric lock, and keep the software up to date. Avoid clicking suspicious links or downloading unknown apps that could contain malware. On computers, use antivirus software and keep your OS updated. A common hacking method is through malware that, for example, can detect crypto addresses in your clipboard and replace them with the hacker’s address. By keeping a clean device and being cautious of downloads, you minimize this risk. (As our Brainstak Crypto Market Update May 2025 noted, maintaining good “OPSEC” like using hardware wallets, enabling 2FA, and avoiding sketchy downloads is all part of safeguarding your assets in today’s crypto environment.)

4. Beware of Phishing and Scams: Crypto users are often targeted by scammers. They might send emails or DMs pretending to be support staff of wallet companies or exchanges, asking for your info. They may create fake websites that look like MetaMask or Coinbase, etc. Always verify you are on the correct official website (check the URL spelling). If you need support, only use official support channels – and know that real staff will never ask for your seed phrase. When downloading wallet apps or updates, only use official app stores or websites. If you use browser-based wallets or extensions, double-check that you’re installing the legitimate one. A little paranoia goes a long way in crypto security!

5. Enable Additional Security Features: Take advantage of any extra security features your wallet or exchange offers. For example, Coinbase allows you to set up withdrawal address whitelisting (meaning your Coinbase account can only withdraw to addresses you pre-approved) – this can prevent a lot of hack scenarios on exchanges. They also support hardware security keys for 2FA. Trust Wallet, being a simple app, doesn’t have 2FA, but you can use a strong PIN and biometric lock. Some wallets allow multi-signature (requiring two or more devices/people to sign a transaction) – this is more advanced but very secure if you set it up. If you’re just starting out, at least have a strong app password and device lock.

6. Test Backup & Recovery: It’s one thing to write down your recovery phrase; it’s another to be sure it actually works. You don’t want to find out in an emergency that you wrote one word illegibly! A safe way to test this is: once you’ve set up your wallet and maybe have a small amount in it, try to restore that wallet on a different device using your seed phrase (or in a different wallet app that supports it). For instance, you could install Trust Wallet on a second phone, choose “I already have a wallet,” and enter your 12 words to see if it restores the same accounts. If it does, you know your backup is correct. After testing, wipe that test instance (you don’t want your phrase floating around). This step is optional but highly reassuring.

7. Stay Informed: Crypto is an evolving space. New security threats emerge (like clever phishing tactics or malware targeting specific wallets), and wallet providers also issue important security updates. Stay informed through official blog posts or social media of the wallet you use. If your wallet app prompts an update, read the notes and update it – sometimes updates patch vulnerabilities. Following general crypto security news helps too. For example, in late 2024, there were reports of malware targeting certain wallet apps via third-party softwarehackread.com. Knowing that, users could be extra careful about what they install. Being aware of the latest scams (like “pig butchering” scams or fake airdrops) can save you from a costly mistake.

(On that note, internal link: If you want to keep up with crypto trends and news, check out our Crypto Market Update May 2025 for insights – staying informed about the market can also help you make safer decisions, not just technically but financially.)

8. Consider Using Multiple Wallets: As you get more comfortable, you might use multiple wallets for different purposes. For example, you could keep a “spending wallet” on your phone with smaller amounts for daily use, and a “savings wallet” (maybe a hardware wallet) stored safely for the bulk of your funds. This way, if your daily wallet is ever compromised or simply lost, the damage is limited. It’s similar to not carrying all your life savings in your physical wallet.

9. Use Trusted Networks: Avoid doing sensitive wallet operations on public Wi-Fi networks. Public Wi-Fi can be susceptible to man-in-the-middle attacks. If you must use it, consider using a VPN for an extra layer of encryption. But ideally, do your transactions on a secure network.

By following these tips, you’ll greatly reduce the risk of losing your crypto to theft or accidents. Now, with security in mind, let’s address those burning questions you might have about specific wallet services. We’ll examine whether popular wallets are safe in 2025 – including Coinbase Wallet, Exodus, Trust Wallet, Mycelium, Robinhood, and Arculus. If you’ve heard of these or are considering them, read on to see how they stack up security-wise and what precautions to take.

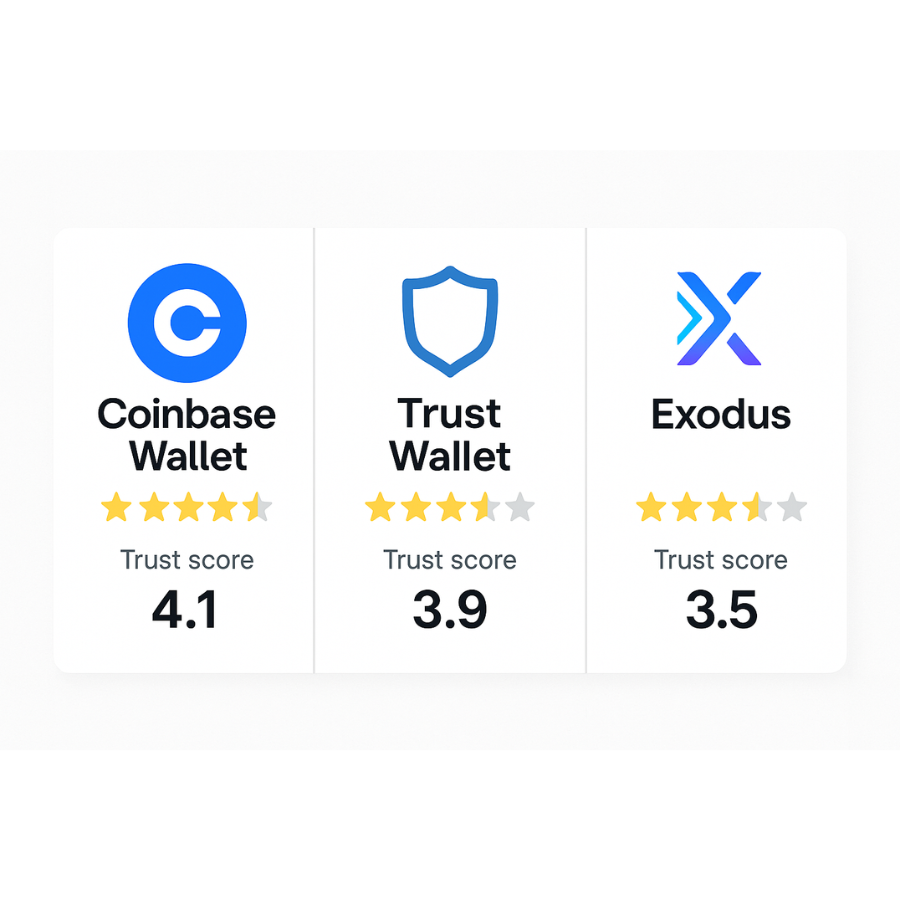

Are Popular Wallets Safe? (Coinbase, Exodus, Trust Wallet & More)

One of the most common questions beginners ask is, “Is [XYZ] wallet safe?” It’s smart to be cautious! In this section, we’ll go through some of the well-known wallet options and discuss their safety. We’ll cover: Coinbase Wallet, Exodus, Trust Wallet (including the query “is Trust Wallet safe from hackers?”), Mycelium, Robinhood Wallet, and Arculus. Each has its own security model and reputation. Let’s dive in:

Is Coinbase Wallet Safe?

Coinbase Wallet (not to be confused with the Coinbase exchange app) is a non-custodial mobile wallet provided by Coinbase. You hold your own keys with Coinbase Wallet, which means you get a recovery phrase and you are in control.

Safety features: Coinbase Wallet is regarded as one of the safer software wallets. It has options like cloud backup of your recovery phrase (encrypted with a password) to Google Drive or iCloud – convenient, but use it carefully (make sure the password is very strong if you use this feature, or opt to just keep your own offline backup). The app can be secured with a PIN or biometric lock. It also includes a feature to preview decentralized app (dApp) transactions and a blocklist to warn you if you’re interacting with known malicious addresses – very handy for avoiding scams in the Web3 world. In terms of code security, Coinbase Wallet’s code is audited and backed by a reputable company.

Overall: Yes, Coinbase Wallet is generally safe. In fact, it’s often recommended for beginners who want to explore self-custody because of its user-friendly design and Coinbase’s brand trust. According to reviews, “Coinbase Wallet is known for being one of the safest hot wallets to store your crypto assets”bitdegree.org. However, remember it’s still a hot wallet on your phone – not as foolproof as a hardware wallet. If your phone is compromised or if you fall for a phishing trick, you could still lose funds. Also note, Coinbase Wallet (self-custody app) is separate from Coinbase’s exchange custodial accounts. If you’re using the main Coinbase app and website where you log in with email, that’s custodial – Coinbase the company is holding those coins for you (and Coinbase has its own security measures and insurance for that scenario, but you’re trusting them).

To maximize safety with Coinbase Wallet: keep your app updated, use a strong PIN/biometric, and obviously safeguard your recovery phrase. One more thing – is the Coinbase wallet safe from hackers? There have been no known breaches of the Coinbase Wallet app’s cryptography itself. Hacks usually happen due to user error (e.g., giving up the seed in a phishing scam). So we’d say it’s as safe as you make it. Coinbase (the company) has a pretty good security track record, and they even reimburse customers who get tricked in certain scenarios as part of their commitment to security (though don’t rely on that – prevention is better!).

Is Exodus Wallet Safe?

Exodus is a popular software wallet available on desktop and mobile. It’s loved for its beautiful interface and ease of use, supporting 260+ cryptocurrencies. If you’re using or considering Exodus, here’s the lowdown on its safety:

Exodus is a non-custodial wallet, meaning you control the keys via a 12-word recovery phrase. It does not require registration or KYC – you just install and create a wallet.

Safety features: Exodus encrypts your private keys locally on your device. When you set a password in Exodus (which you should), it’s used to encrypt those keys. This means if someone got a copy of your Exodus files but not your password, they’d have a hard time stealing your crypto. However, Exodus does not currently offer 2FA or multi-sig within the wallet – it’s designed to be simple. So your security relies on your device’s security and your password strength. Also, note that Exodus is partially closed source. The front-end code is visible, but the back-end is proprietary. This has pros and cons: on one hand, not everyone can scrutinize the code for bugs (as they can with fully open-source wallets like Trust or Electrum); on the other hand, Exodus has a professional team that presumably tests and secures it. There haven’t been reports of major exploits in Exodus itself.

One known risk: since Exodus is a hot wallet, if your computer is infected with certain malware, there’s a chance a hacker could grab your unencrypted keys when you open the wallet (especially if your password is weak or they install a keylogger). In 2024, security researchers found malware targeting popular wallets like Exodus and Atomic Wallet via trojanized software downloadshackread.com. This underscores why you should keep good antivirus and be careful what you install.

Exodus + hardware: A great feature is that Exodus can integrate with Trezor hardware wallets. So, you can manage your funds in the nice Exodus interface, while the private keys stay on your Trezor device. If you have a Trezor, this can dramatically boost security. As of 2025, Exodus also started supporting Ledger devices through their interface (according to some sources), which is cool for Ledger users wanting to use Exodus UI.

Overall: Exodus wallet is safe to use for most people, as long as you follow standard security practices. The company behind it has been around since 2016 with no major incidents. Users say “Exodus is as safe as you keep your 12-word phrase”reddit.com – meaning the onus is on you to protect that phrase. The wallet itself won’t magically lose your funds; it’s usually user mistakes or compromised devices that cause trouble. It’s wise not to keep life-changing money in any single hot wallet though. If you really like Exodus, you can keep a chunk there for convenience and maybe move bigger HODL amounts to cold storage later.

Is Trust Wallet Safe?

Trust Wallet is the official crypto wallet of Binance and is a very popular mobile wallet (available on Android and iOS). It’s completely free and supports a ton of cryptocurrencies and tokens (especially good for DeFi and NFTs too). Being a mobile app, Trust Wallet is a hot wallet.

Open-source and community vetted: One big plus is Trust Wallet is open-source. Its code has been reviewed by the community, which adds to confidence (more eyes on the code can catch vulnerabilities). It doesn’t collect personal data, and like other non-custodial wallets, it gives you a recovery phrase that you must guard.

Security features: Trust Wallet allows you to set a 6-digit PIN (or biometric unlock) to access the app. Always enable that! It also has an optional feature to authorize transactions with a password/PIN each time (depending on the version). Trust Wallet does not natively support 2FA or multi-sig. So again, the security relies heavily on your phone’s security and you keeping the seed phrase safe. The app itself is relatively simple and has a good security track record; there have been no known hacks of the Trust Wallet app encryption.

“Is Trust Wallet safe from hackers?” – Many people ask this. Generally, yes, Trust Wallet is safe from hackers in the sense that there’s no backdoor; your keys never leave your device. However, if your device is compromised (say you accidentally installed malware from a sketchy app or someone uses a spyware on a jailbroken phone), then a hacker could potentially get into the wallet. Also, users have been duped by scams where a fake Trust Wallet support or a fake DApp asks for your seed phrase – and once that’s given up, funds are gone. Trust Wallet itself can’t protect you from those social engineering attacks. There was an incident in 2023 where some Trust Wallet users fell for phishing sites that mimicked the wallet interface, for example. So the wallet is safe, but you must remain vigilant on how you use it.

For extra safety on Trust Wallet: Keep your phone OS updated, don’t install random APKs (Android users especially), and consider using Trust on a dedicated device that you don’t use for everyday web browsing (if you want to be extra cautious). Since Trust Wallet is so widely used, it’s somewhat a target, but thankfully its simplicity is its strength – less bloat means fewer potential bugs.

In summary, Trust Wallet is considered a secure and reputable option for mobile crypto management. Millions use it safely. Just remember, no wallet is 100% “hacker-proof” if the user is careless. Enable your PIN lock, never share your seed, and you’ll be in good shape.

Is Mycelium Wallet Safe?

Mycelium is a veteran in the Bitcoin wallet space. It’s a mobile wallet (available on Android and iOS) and has been around for over a decade – which in crypto years is forever! It started as a Bitcoin-only wallet and is very popular among Bitcoin enthusiasts for its robust features.

Security and features: Mycelium is open-source and has a strong focus on security. It offers various account types: you can have a standard HD account (with a seed phrase backup), single-address accounts, “watch-only” accounts (to observe cold storage), and it even integrates with hardware wallets like Trezor and Ledger for spending. Mycelium also supports local trader marketplaces and more advanced functions, but focusing on safety: it has a good reputation for being secure. Being open-source, its code has been vetted. Users have held Bitcoin on Mycelium for years without issues as long as they keep the seed safe.

One thing to note: Mycelium’s interface is a bit more old-school and not as flashy or user-friendly as Exodus or Trust. It’s geared toward somewhat experienced users, though a beginner can still use it fine for basic sending/receiving. It doesn’t babysit you with pretty UI, but it’s very functional.

Is Mycelium wallet safe? Yes, Mycelium is safe in terms of software reliability. It encrypts your keys on the device and requires you to set a PIN for spending. Always set that PIN. The wallet can also be set to use offline cold storage (e.g., you could have an offline phone with Mycelium as a cold wallet and a watch-only copy on your online phone – a cool advanced setup). Because it’s Bitcoin-centric, it doesn’t have token approvals or DApp vulnerabilities to worry about; it’s pretty straightforward.

One caution: Mycelium is focused on Bitcoin (and a few others like ETH, ERC-20 tokens now via integrated services, but primarily BTC). If you need to store a wide range of altcoins, Mycelium won’t cover everything, which is why some beginners might skip it. But for Bitcoin, it’s rock solid. The biggest risk again is user error: not backing up the seed, or having your phone compromised. Also, as a mobile app, similar advice: don’t install random apps on the same device that could carry malware.

Overall: Mycelium has a long track record of safety. As one Reddit user humorously implied – holding BTC on Mycelium for 8 years is fine as long as you don’t do something “dumb” like exposing your keysreddit.com. So if you use Mycelium, you’re in good company with many OG Bitcoiners. Just practice standard security hygiene.

Is Robinhood Wallet Safe?

Robinhood, the stock trading app famous for stocks and Dogecoin trading frenzies, launched its own Robinhood Crypto Wallet in the past couple of years. It’s a bit unique because originally, Robinhood let users buy crypto within the app but not withdraw it. Now they have a separate Robinhood Wallet app (sometimes referred to as the Robinhood Web3 Wallet) which is non-custodial and lets users manage their crypto and NFTs, separate from the main Robinhood brokerage app.

So, how does Robinhood Wallet stack up in safety?

Regulation and security measures: Robinhood as a company is a regulated broker-dealer and their crypto arm is registered with FinCEN in the U.S. They are subject to high regulatory standards and auditswallstreetsurvivor.com. They’ve built a reputation (in traditional finance at least) for user-friendly security, like requiring identity verification, etc. For the wallet, specifically, they reportedly keep most custodial holdings in cold storage when they manage crypto for youwallstreetsurvivor.com. But in the context of the Robinhood Wallet app (the new one), it’s actually a self-custody wallet – meaning you hold the keys (similar to Coinbase Wallet or Trust).

Non-custodial aspect: The new Robinhood Wallet gives you a seed phrase just like other wallets, so you have full control. This is great for freedom, but also means you have the responsibility to secure it (Robinhood can’t help you recover funds if you lose the keys). The app likely has a PIN/Biometric lock feature – definitely use that. Also, since it’s tied to Robinhood, you probably need your Robinhood account to access it, which has its own login and 2FA. This could add a layer of security (someone would need both your Robinhood login and your wallet PIN to get in, presumably).

Is it safe? There’s no long history yet, but so far Robinhood Wallet appears to be safe and well-built. It’s non-custodial, which is good for privacy and control. Robinhood’s brand means they took some time to ensure security (they even had a waitlist and gradual rollout, possibly to iron out issues). They also emphasize security education; being a big company, they have resources to invest in security. As a user, one risk is confusion – make sure you know the difference between your funds on Robinhood’s main app (which they custody) and funds in the Robinhood Wallet app (which you custody). The wallet has the advantage that it can connect to Web3 (Ethereum and Polygon networks for instance), so you can do more with your crypto.

If you’re using Robinhood Wallet: treat it like any mobile wallet. Secure your seed phrase, enable all locks, and be cautious of phishing. The good thing is, to use the wallet you must verify your identity with Robinhood and enable 2FA on your Robinhood accountwallstreetsurvivor.comwallstreetsurvivor.com. Those requirements add security (since a random thief would have trouble getting past Robinhood’s account security to even use your wallet app). In essence, the Robinhood Wallet is as safe as other reputable hot wallets, with the backing of a regulated company. Just remember, you’re still holding the private keys, so you need to be responsible like with Trust or Coinbase Wallet.

Is Arculus Wallet Safe?

Arculus is a newer player in the crypto wallet world, marketed as a modern cold storage solution. It’s a bit different from the typical USB-stick hardware wallets. Arculus consists of a metal smart card (the size of a credit card) and a mobile app. It uses 3-factor authentication: something you have (the Arculus Key Card), something you know (a 6-digit PIN), and something you are (optional biometric on your phone). To use your wallet, you tap the Arculus card to your phone (NFC) and enter your PIN (and maybe fingerprint). Only then can you authorize transactions.

So, is Arculus safe? Yes, Arculus is considered a very secure way to store crypto. Here’s why:

- Your private keys are generated and stored on the Arculus card’s secure element chip (rated CC EAL6+ security, which is a high level of hardware security) coinwirez.com. Those keys never leave the card or touch the internet. The card is like a vault for your keys.

- Without the card, the PIN, and your biometric, no one can access your wallet. Even if someone stole your phone, they can’t do anything without the physical card and knowing your PIN. If someone stole your card, it’s useless without your PIN (and arguably your biometric if that’s required by the app).

- Since it’s essentially a hardware wallet in card form, it’s immune to remote hacking. A hacker would have to physically obtain your card and break your PIN (which is only 6 digits, but presumably with lockouts after wrong attempts).

- Arculus does not require any personal info or KYC just to use the wallet. Privacy-wise it’s good. Only if you use their partner services to buy/sell crypto in-app would you do KYC with those providerscoinwirez.com.

- Backup: You still get a 12 or 24-word recovery phrase when setting up Arculus (in case you lose the card, you can recover on a new card or a different wallet)coinwirez.com. So you must secure that phrase similar to other wallets.

- The only slight downsides: The Arculus card costs money (about $99) and if you lose it and your recovery phrase, then you’d be in trouble. But that’s true of any hardware wallet (lose device + no backup = loss of funds). Also, Arculus is relatively new, so it hasn’t been as battle-tested as Ledger or Trezor by the community over many years. But no significant issues have been reported as of 2025.

Overall safety: Arculus is very safe against hackers and malware. It’s essentially a cold wallet that’s easy to use with your phone. If you ask “is Arculus wallet safe from hackers?” – the answer is a strong yes, by design. The multi-factor requirement makes it one of the more secure setups for everyday users because it reduces reliance on just “something you know” or “something you have” – it needs both.

For perspective, even a security-conscious site like CoinWirez concluded “Arculus wallet is a secure and reliable way to keep your crypto and NFTs”, highlighting the 3-factor auth and offline key storagecoinwirez.com. So if you want a hardware wallet experience without a dongle, Arculus is a solid choice in 2025.

Those are the safety rundowns of the major wallets in question. To summarize in plain terms:

- Coinbase Wallet: Safe for a hot wallet, user holds keys. Just be careful with phishing. Good for beginners, decent security features.

- Exodus: Safe and user-friendly, no major issues historically. Remember it’s only as secure as your device. Great with a hardware wallet attached.

- Trust Wallet: Safe and widely trusted. Open-source. Protect that seed and your phone – the wallet won’t let you down if you don’t let yourself down.

- Mycelium: Safe, hardcore Bitcoin wallet. Long track record. Security is excellent, just Bitcoin-focused.

- Robinhood Wallet: Seems safe, has corporate security standards behind it plus self-custody. Still new, but no red flags. Use strong Robinhood account security in tandem.

- Arculus: Very safe (hardware wallet-level safety). Good for peace of mind against remote hacks. Just don’t lose the card or phrase.

Now that you have your wallet and know how to keep it safe, one more question remains: How do you turn crypto back into regular money? Specifically, a lot of users ask “how do I cash out from Coinbase?” or “how do I cash out on Coinbase?”. We’ll cover that next, so you’re prepared not only to get into crypto but also to exit when you need to (hopefully with some profits!).

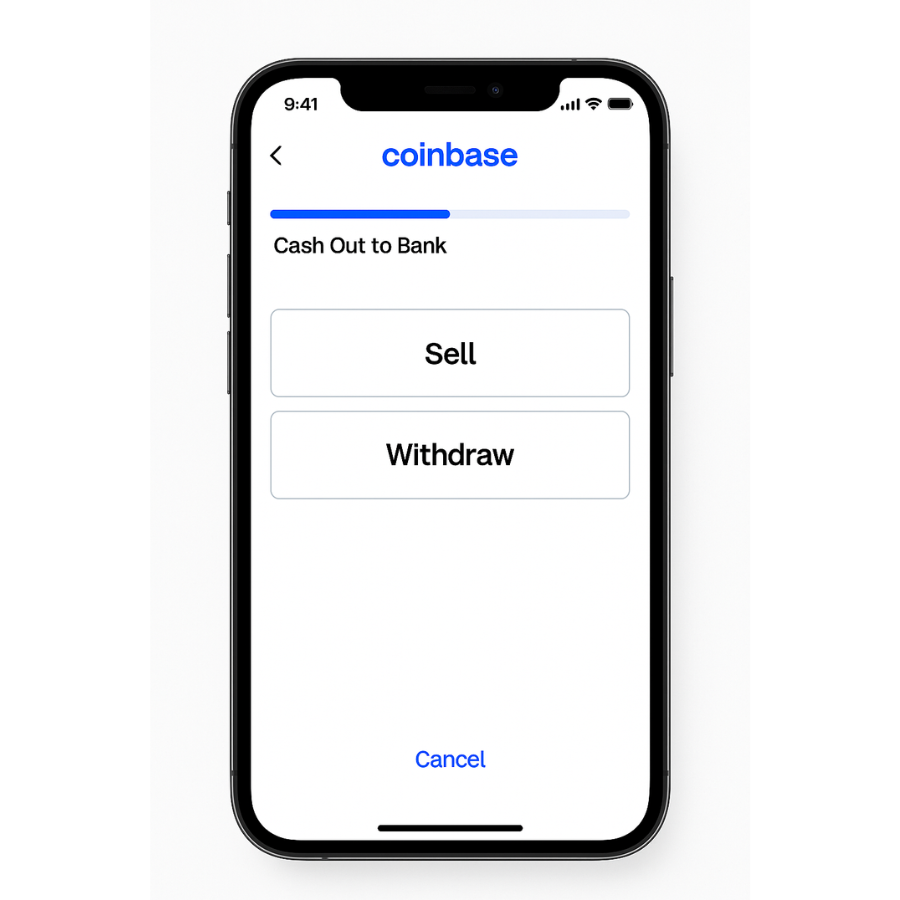

How to Cash Out from Coinbase (Withdraw to Bank)

If you’ve been using Coinbase (or Coinbase Wallet) and now you’re wondering, “How do I cash out from Coinbase?”, you’re essentially looking to convert your crypto into fiat currency (like USD, EUR, etc.) and withdraw it to your bank or another platform. This is a crucial part of the journey – after all, gains aren’t real until they’re in your bank account, as the saying goes. Let’s break down the process step by step:

1. Are you using Coinbase or Coinbase Wallet? First, clarify if your crypto is on Coinbase (the exchange) or in Coinbase Wallet (the self-custody app), because the process is different:

- If your funds are in the Coinbase exchange account, cashing out is straightforward within Coinbase’s app or website.

- If your funds are in Coinbase Wallet (self-custody app), you cannot directly “cash out” to fiat from that app, because it doesn’t deal with fiat. You’d need to send your crypto from Coinbase Wallet to an exchange (like Coinbase or Binance) to sell for cash.

Let’s assume the common scenario: you bought crypto on Coinbase, and now you want to withdraw money.

2. Sell your crypto for cash on Coinbase: In Coinbase, you have crypto balances and a cash account balance (in your currency). To cash out, you first need to sell your crypto to convert it into that cash balance. Using the Coinbase app or website:

- Navigate to Trade or Sell.

- Choose the cryptocurrency you want to sell, and enter the amount.

- Select “Sell for USD” (or your local fiat currency).

- Complete the sell order. Coinbase will show you the conversion rate and any fees before you confirm.

- After selling, you will have an amount of USD (or EUR, GBP, etc.) in your Fiat Wallet on Coinbase.

(Note: Coinbase charges a fee or spread on trades. There might also be tax implications for selling crypto – something to be mindful of, though that’s outside this guide’s scope.)

3. Withdraw (Cash Out) to your bank or PayPal: Now that you have a cash balance on Coinbase, you can withdraw it:

- Go to the Assets or Portfolio section on Coinbase and select your USD (or fiat) balance.

- Click on Withdraw or Cash Out.

- Choose the destination for your funds. Typically, you’ll have options like a bank account (via ACH or wire in the US, SEPA in EU, etc.) or PayPal for smaller amounts, and possibly a debit card cash-out.

- If you haven’t already, you’ll need to link a bank account or PayPal to Coinbase. This usually involves providing your bank details or logging into PayPal to connect. (There might be a small verification process for banks, like confirming micro-deposits, which could take a couple of days on first setup.)

- Enter the amount you want to withdraw and confirm. Coinbase will show any withdrawal fee (ACH is typically free in the US, SEPA may have small fee, wire transfers might have a fee).

- Confirm the withdrawal. You should get a confirmation screen.

4. Wait for the funds to arrive: Withdrawal times vary:

- Bank ACH transfers (common in US) can take 1-3 business days to show in your bank account.

- SEPA transfers (EU) usually 1-2 days.

- Instant cash-out to debit card (if you used that) can be near-instant but often has a fee.

- PayPal withdrawals can be pretty quick (sometimes minutes or a few hours).

- Coinbase might have a short holding period for new users or after large sales for security reasons. Check if your funds are marked as “available.” Usually, after selling, you can withdraw immediately unless there’s a hold (which they’d display).

5. That’s it – you’ve cashed out! The money should land in your bank or PayPal. Keep an eye on your email or notifications – Coinbase sends updates when withdrawals initiate and complete.

What about cashing out from Coinbase Wallet? If your crypto is in the Coinbase Wallet app, the wallet has no built-in cash-out feature because it’s decentralized. To cash out, you would:

- Send the crypto from Coinbase Wallet to your Coinbase account (or another exchange). For example, open Coinbase Wallet, send your Bitcoin or Ethereum to your Coinbase deposit address (you can find this in the Coinbase app by clicking “Receive” on the asset).

- Once the crypto arrives in your Coinbase exchange account (usually within minutes, depending on the blockchain speed and fees you set), follow the same steps to sell and withdraw as above.

- Be mindful of network fees when transferring from your wallet to the exchange. For instance, sending ETH on Ethereum can have significant gas fees, so plan accordingly. Sometimes converting assets to a cheaper network token (like sending via Polygon or using a cheaper coin) can save fees, but that adds complexity. For beginners, stick to straightforward methods, just note there will be a miner fee for the transfer.

Is there a fee to cash out on Coinbase? Coinbase does not charge a direct fee for withdrawing USD to a bank via standard methods (ACH/SEPA) aside from possible bank charges on wires, etc. However, Coinbase’s fees are mostly in the trading step (selling your crypto). PayPal or instant card withdrawals may have a fee (a small percentage). Always review the confirmation screen which will list any fees.

Security tips when cashing out:

- Make sure you’re using the real Coinbase site or app. Cashing out involves sensitive info (like bank details), so double-check the URL (should be coinbase.com) or that your app is official.

- Beware of phishing emails that might say “click here to withdraw funds” – always initiate from your known login, not via email links.

- If withdrawing a large amount, you might consider doing a small test withdrawal to your bank first to ensure the connection works, especially if it’s your first time linking that bank.

- Coinbase may sometimes delay or review big withdrawals for security – if that happens, don’t panic, just follow their instructions (they may ask for additional verification).

Cashing out on Coinbase is generally user-friendly and one of the reasons Coinbase is popular – it bridges crypto and traditional finance smoothly. The same basic process applies on other exchanges like Binance, Kraken, etc., though the interfaces differ slightly.

Now you know how to create a crypto wallet, keep it safe, and even cash out when needed. We’ve covered a lot, but before we wrap up, let’s summarize and address a few frequently asked questions that often pop up for newcomers:

Conclusion & Frequently Asked Questions

By now, you should know exactly how do I create a crypto wallet safely in 2025 and which wallet fits you best. Creating a crypto wallet is your ticket to participating in the crypto world with full control over your assets. By now, you should feel comfortable with how to create a crypto wallet (and a wallet address), and you’ve learned crucial tips on staying safe while using it. We discussed the safety of popular wallets like Coinbase Wallet, Exodus, Trust Wallet, Mycelium, Robinhood, and Arculus – and in all cases, the theme is: they are as safe as you, the user, make them. Secure your recovery phrase, use strong passwords, consider hardware wallets for big holdings, and be on guard against scams. Crypto empowers you to be your own bank – which is amazing – but it also means you’re your own security officer.

To round things off, here’s a quick FAQ section to clear up any final questions:

How do I create a crypto wallet on mobile?

Start by choosing a reliable wallet app (like Coinbase Wallet, Trust Wallet, or Exodus), then follow these steps on how do I create a crypto wallet:

- Download the app from the official App Store or Google Play Store.

- Open the app and select “Create New Wallet.”

- Set a strong password or PIN that only you know.

- Back up your recovery phrase — this is crucial! Write it down and store it safely (not online).

- Confirm your backup phrase when prompted.

- Your crypto wallet is now ready, and you’ll be shown your wallet address — a string of numbers and letters used to receive crypto.

That’s it! You’ve just learned how to create a crypto wallet

Q: Is the Coinbase wallet safe to use for my crypto?

Yes, Coinbase Wallet (the self-custody app) is generally safe and one of the top hot wallets available. It has strong security features for a software wallet. Just remember to safeguard your recovery phrase and use the app’s security options (PIN/biometrics). No one can access your Coinbase Wallet funds unless they get your seed phrase or unlock your phone. If you meant the Coinbase exchange account: Coinbase (the company) is also considered secure and is heavily regulated, but it’s a custodial service (they hold the keys). Many users trust it, but keeping large amounts long-term in any exchange is less safe than your own wallet. Using Coinbase’s exchange for convenience and Coinbase Wallet for storage can give a good balance.

How do I cash out on Coinbase if I have Bitcoin there?

To cash out on Coinbase, sell your Bitcoin (or other crypto) for your local currency within the Coinbase app/website, then withdraw that cash to your linked bank account or PayPal. In short: Trade -> Sell crypto to USD (for example) -> Withdraw USD to bank. The process usually takes a couple of clicks and a couple of days for the bank transfer. If your crypto is not already on Coinbase, you’d first send it there. Always double-check you’re on the official Coinbase platform when doing this. We outlined detailed steps in the section above, so you can scroll up if you need the step-by-step

What is the safest crypto wallet in 2025 for beginners?

The “safest” can depend on your needs. For pure security, hardware wallets like Ledger or Trezor are the safest since they keep keys offline. But for beginners, the safest approach might be to use a well-known software wallet like Trust Wallet or Coinbase Wallet for small amounts while you learn, and eventually migrate to a hardware wallet for larger savings. Arculus is also a strong contender in 2025 for safety with its 3-factor auth, blending ease of use and security. Ultimately, whichever wallet you use, following the safety tips (offline backups, device security, etc.) is what makes it truly safe. Even the best wallet can be compromised by user mistakes, so knowledge is your best defense.

Is it free to create a crypto wallet?

Yes! Creating a software crypto wallet is completely free. Wallet apps like Trust, Coinbase Wallet, Exodus, etc., cost nothing to download and set up. You might pay network fees when sending transactions (that’s not the wallet charging, it’s the blockchain), but generating the wallet and address is free. Hardware wallets, however, do cost money to purchase – but once you have the device, generating wallets on it is also free (again, just network fees when moving crypto). Be wary of any service that tries to charge you just to create a standard wallet or address – most likely unnecessary or a scam. Reputable wallets make money through other means (some take optional swap fees, etc.) but not for basic wallet creation.

What happens if I lose my recovery phrase or hardware wallet?

If you lose your recovery phrase and still have access to your wallet, immediately create a new wallet and transfer your funds to the new one (because without the phrase, if anything happens to your current device, you’d be locked out permanently). If you lost the phrase and the device (or app) – unfortunately, the funds are likely lost forever. No one (not even the wallet company) can help recover a wallet without that phrase, by design. It’s like losing the master key to a vault. If you lose a hardware wallet device but do have your recovery phrase, you’re fine – you can recover your wallet on a new device or software wallet using the phrase. Similarly, if you lose your phone that had Trust Wallet, you can re-install Trust on a new phone and use your 12-word phrase to get everything back. The important thing is having backups of those critical words. This is why we hammer on about writing them down and keeping them safe.

Can I have multiple crypto wallets?

Absolutely. You can create multiple wallets if you want – there’s no limit. Some people use different wallets for different purposes (e.g., one for daily trading, one for long-term holding, one for interacting with experimental DeFi apps, etc.). It’s actually a good security practice to diversify so that not all your eggs are in one basket. Just make sure you have clear records of the recovery phrases for each and maybe label them so you don’t mix them up. Also, it’s worth noting many wallets (like Trust or Exodus) allow multiple accounts within one app too, if you want to manage multiple sets of addresses under one interface. But managing separate wallet apps/devices can add security through compartmentalization.

Final thoughts: Creating a crypto wallet in 2025 is a straightforward process that puts you in the driver’s seat of your digital assets. With this guide, you not only learned how to create a wallet address and wallet step by step, but also how to stay safe while navigating the exciting world of crypto. The key takeaways are: always protect your secret keys, double-check what you’re doing when sending or receiving funds, and be cautious of the common pitfalls (phishing, malware, etc.). Crypto gives you freedom – and with a little effort and the tips above, you can enjoy that freedom without fear.

Now you’re ready to confidently create your crypto wallet and begin your journey. Welcome to the world of decentralized finance, and happy crypto adventures! Stay secure and enjoy the empowerment that comes with being in full control of your own wallet. If you found this guide helpful, feel free to bookmark it or share it with fellow crypto-curious friends. And remember, the team at Brainstak is here to provide more beginner tips and updates (like our internal guides on tech tips or monthly crypto updates) to help you along the way. Good luck and stay safe out there!

[Power Tip: Keep learning and stay updated – the crypto landscape can change fast. Following security best practices and continuous learning is the ultimate combo to ensure your crypto journey in 2025 is both prosperous and secure.]

Pingback: 🚨 Scam Alert 2025: List of Fake Crypto Exchanges You Must Avoid (Shocking List)

Pingback: 7 Warning Signs: How to Identify Fake Cryptocurrency & Scam

Pingback: Non-Custodial vs Custodial Wallets: Discover the Safer Choice for 2025