Now Reading: Lear Director Stock Sale Analysis: What’s Really Going On?

-

01

Lear Director Stock Sale Analysis: What’s Really Going On?

Lear Director Stock Sale Analysis: What’s Really Going On?

Introduction: Why Your Attention Matters

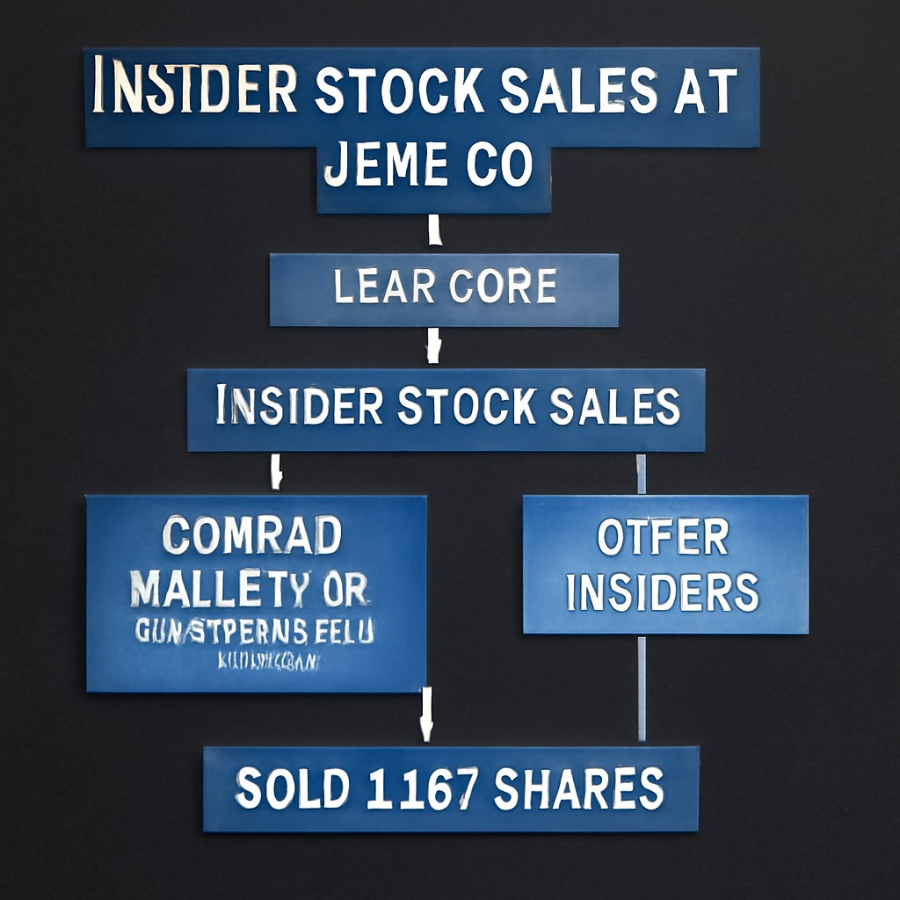

The Lear Director Stock Sale Analysis has recently gained significant attention in the market. On June 17, 2025, Lear director Conrad Mallett Jr. offloaded 1,187 shares of Lear Co, raising eyebrows among investors. But does this indicate a red flag for the company’s future, or is it just a personal decision by the director? In this analysis, we’ll break down:

- What the sale says about Lear as a company

- How tariffs may be weighing on Lear stock

- Which signals matter most for your investment strategy in Lear Co

Lear, a global leader in automotive seating and electrical systems, operates in a highly volatile sector. With this insider sale taking place amid tariff impacts and trade uncertainties, it’s essential to explore the implications of this transaction and how it fits into the broader economic landscape.

Lear Company at a Glance

Founded in 1917, Lear Incorporated (also known as Lear Co) is a global leader in automotive seating and electrical systems. With over 55 million shares outstanding and ~£4 billion market cap, it’s a key player in the auto parts industry.

Lear’s multi-pronged portfolio includes:

“Learn more about auto industry macro‑forces like tariffs and supply chain risks” → https://brainstak.com/ios-26-ipados-26-features-beta-supported-devices-2/

- seating systems for OEMs (Ford, GM, Toyota)

- power modules and connectivity tech for EVs

- extensive global operations

Lear Company at a Glance

Overview of Lear Co:

Founded in 1917, Lear Incorporated, also known as Lear Co, is one of the world’s leading manufacturers of automotive seating systems and electrical components. With a market cap of around £4 billion and over 55 million shares outstanding, Lear plays a crucial role in the global auto parts industry.

While tariff concerns weigh on the company’s short-term performance, Lear’s pivot towards EV technologies offers a promising growth opportunity. For a deeper look at how the electric vehicle industry is growing and shaping the future of automotive companies like Lear, visit this article on the rise of the EV market.”

Here are some key aspects of Lear Co:

- Seating Systems: Lear supplies seating solutions to major OEMs (Original Equipment Manufacturers) such as Ford, GM, and Toyota.

- Electric Vehicle (EV) Focus: Lear is also heavily invested in producing power modules and connectivity technology for electric vehicles (EVs).

- Global Presence: Lear operates extensively across North America, Europe, and Asia, with 8 plants in Mexico, making it particularly vulnerable to global tariff impacts.

Learn more about the macro-forces influencing the automotive industry

What Happened? The Insider Sale Explained

On June 17, 2025, Conrad L. Mallett Jr., a director at Lear, sold 1,187 shares at a price of £73.88 each, totaling roughly £87,700 (around $118,000 USD). While insider sales are common, this one caught attention due to its timing and the broader market context.

Why This Sale Matters:

- Director-level sales are closely monitored by investors and analysts, as they can be viewed as a signal of confidence (or lack thereof) in the company.

- This sale occurred at a time when Lear stock has been struggling, hovering near yearly lows due to economic pressures, including trade tariff concerns.

- The sale coincides with the ongoing uncertainty in the auto industry, particularly the impact of tariffs on Mexican auto exports.

Understanding the Significance of Director-Level Sales

Insights from Behavioral Finance

In behavioral finance, director-level stock sales can be viewed in two ways:

- Personal Reasons: Directors often sell stock for personal reasons like taxes, portfolio rebalancing, or expansion.

- Declining Confidence: When directors sell significant amounts of stock, especially without corresponding purchases, it can signal a lack of confidence in the company’s future prospects.

What to Watch for:

- Sale Size: Mallett’s sale of 1,187 shares is moderate (~0.002% of total shares), which in itself isn’t necessarily alarming. However, it’s important to track if there are multiple sales from other directors or insiders in the coming months.

- No Insider Purchases: The fact that there have been no insider purchases recently could be a bearish signal. Often, when insiders buy, it signals confidence in the company’s future performance.

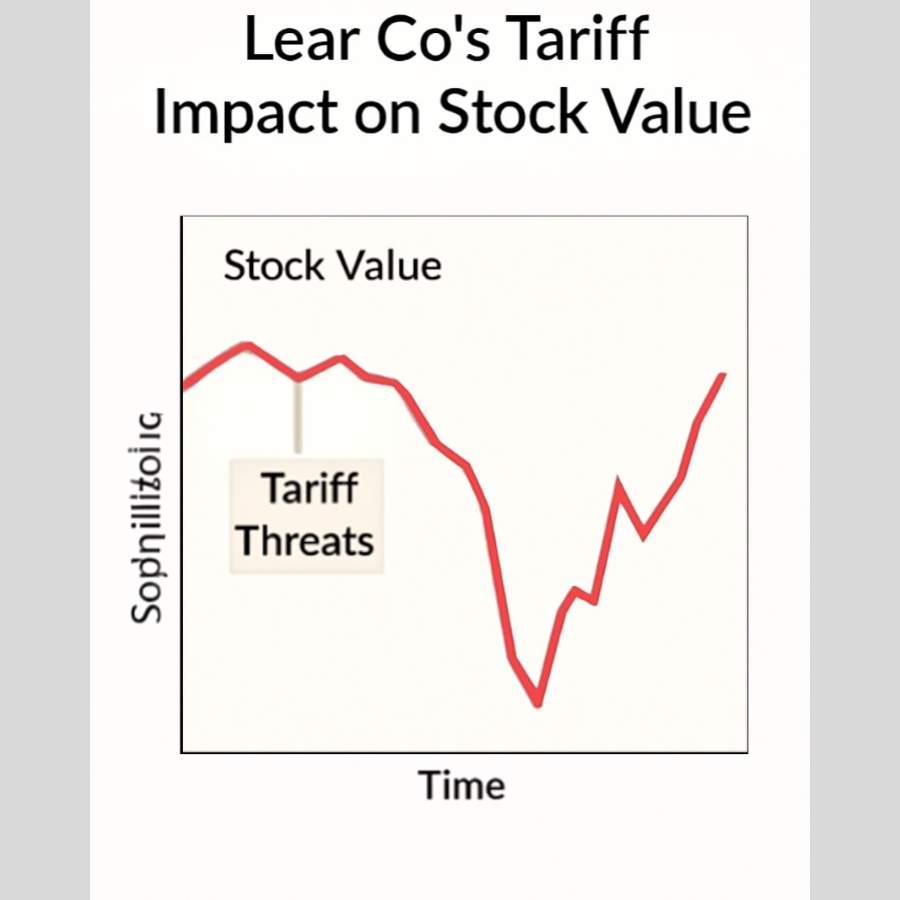

Lear Stock Tariff Impact: The Economic Headwinds

Tariff Threat to Lear Co

The looming threat of tariffs, particularly 25% tariffs on Mexican auto exports, has added pressure to Lear Co‘s stock value. With Lear operating 8 plants in Mexico, any increase in tariffs will result in higher costs and supply chain disruptions. Let’s explore the financial toll these tariffs may be taking.

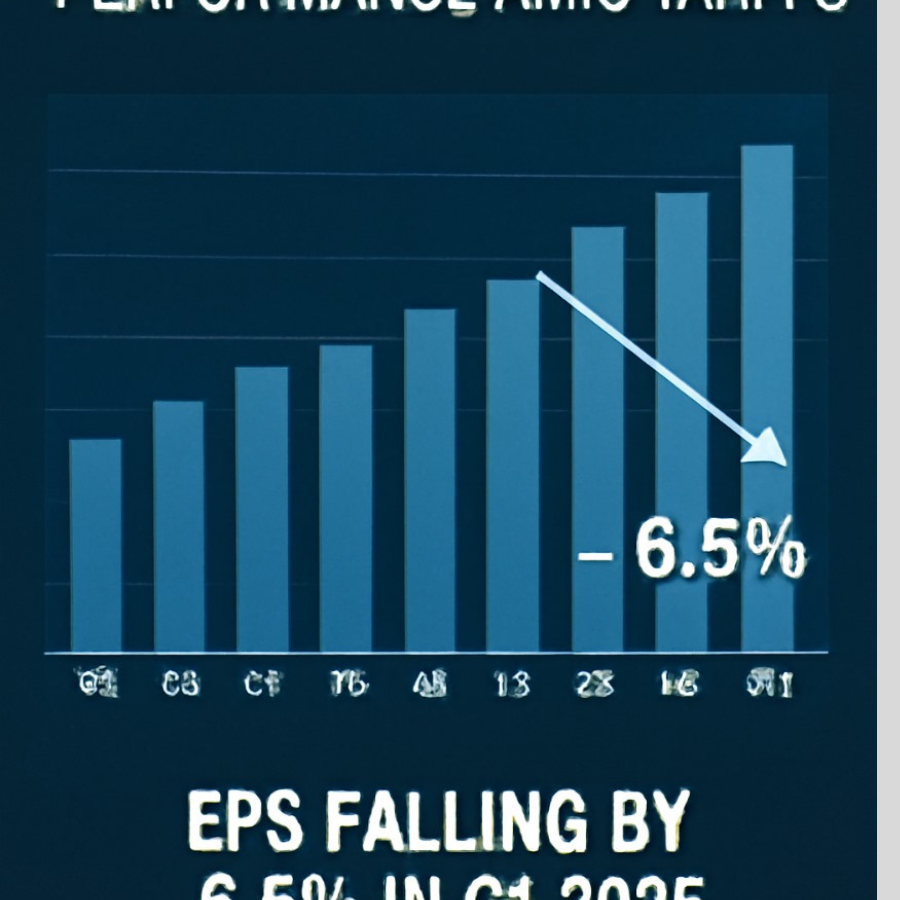

- Financial Toll: Lear’s Earnings Per Share (EPS) fell by approximately 6.5% in Q1 2025, partially due to inflationary pressures and tariff risks. The stock is now hovering near its yearly low at around £58.91, compared to its peak of £91.24 last June.

- Tariff-Related Downgrades: Leading investment banks like Morgan Stanley and JPMorgan have recently downgraded Lear stock, citing tariff headwinds as one of the key concerns.

Short-Term Market Volatility:

- After the announcement of the insider sale, Lear’s shares dropped around 3%, which suggests a short-term bearish sentiment surrounding the stock.

- With Lear Co operating 8 plants in Mexico, increased costs and supply chain volatility due to tariffs have posed serious risks. For more on how trade policies are reshaping the automotive sector, check out this insightful article on global trade policy and its impact on businesses.

Market Reaction & Analyst Insights

Investor sentiment on Lear stock is divided following the insider sale:

- Some investors perceive the director’s sale as a warning sign of potential trouble.

- Others view it as a routine or personal decision unrelated to the company’s long-term prospects.

Analyst Perspectives:

- JPMorgan recently raised Lear’s target price, citing the company’s efforts to push for cost-efficiency despite tariff pressures.

- Morgan Stanley remains bullish on Lear’s EV pivot, noting that the company is positioning itself well in the growing electric vehicle market.

- However, MarketWatch has warned that demand remains weak in key markets like Europe and China, which may impact future growth.

Balanced View: Signal or Routine?

Key Factors to Consider:

- Sale Size Matters: Mallett’s sale is small relative to the total shares outstanding (less than 0.01% of total shares), which reduces the significance of this sale.

- Frequency of Sales: There have been no multiple insider sales recently, which reduces the likelihood that this is part of a larger trend of declining confidence.

- Timing: The sale occurred during a challenging macro environment, with tariff risks and supply chain issues weighing on the company’s performance. This suggests the sale could be a precautionary move rather than a sign of internal trouble at Lear Co.

What Investors Should Monitor Next

Here’s what investors should keep an eye on going forward:

- Earnings Reports for Q2–Q3 2025: Lear’s quarterly earnings will provide insight into how the company is navigating tariff risks and inflationary pressures.

- Tariff News: Any resolution or delay in the US-Mexico trade talks could significantly impact Lear’s bottom line.

- Insider Transactions: Are other insiders buying or selling shares? This could provide further insight into Lear’s outlook.

- Macro Automotive Trends: Key factors like EV production, chip shortages, and regional demand will continue to influence Lear’s performance.

Conclusion: Navigating the Terrain Ahead

In conclusion, the Lear Director Stock Sale Analysis reveals a mixed signal for investors. The sale by Conrad Mallett Jr. is relatively minor and may be a personal decision rather than a reflection of company performance. However, trade policy instability, especially the tariff risks, remains a key pressure point for Lear Co.

Long-Term Outlook:

- Lear’s long-term prospects, driven by cost-control initiatives and a strong focus on EV technology, still show potential upside.

- Patient investors who monitor macroeconomic developments and insider transactions may see an opportunity, but for now, the stock remains a mixed signal in the short term.

Stay informed and continue monitoring Lear’s developments, especially the tariff situation and upcoming earnings reports, to make well-informed decisions about your investment strategy.