Now Reading: US Iran Strait of Hormuz Oil Stocks: Global Market Fallout from Operation Midnight Hammer

-

01

US Iran Strait of Hormuz Oil Stocks: Global Market Fallout from Operation Midnight Hammer

US Iran Strait of Hormuz Oil Stocks: Global Market Fallout from Operation Midnight Hammer

Overview: June 2025 Crisis

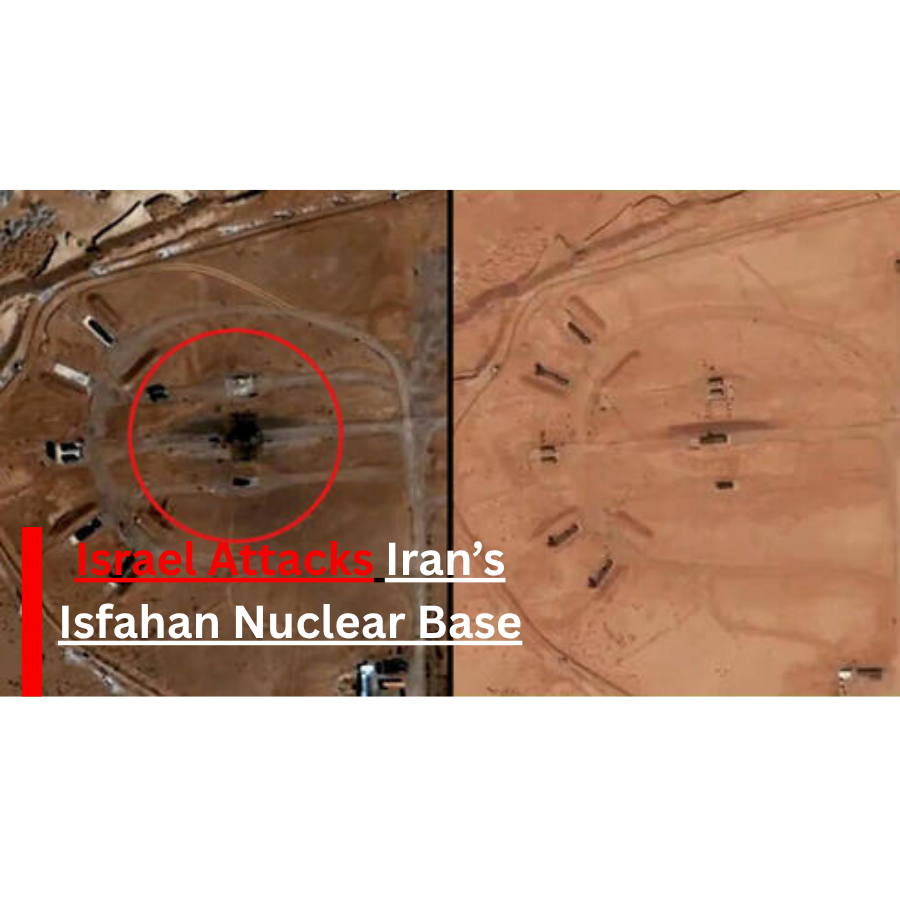

The US Iran Strait of Hormuz oil stocks crisis reached a boiling point in mid-June 2025. A covert operation by Israel, backed by Mossad drone strikes, targeted Iranian nuclear and missile sites. Two days later, on June 22, 2025, the United States launched Operation Midnight Hammer, bombing three key nuclear facilities in Iran: Natanz, Fordow, and Isfahan. At the same time, Iran threatened closure of the strategic Strait of Hormuz, sending shockwaves through global markets.

Operation Midnight Hammer: US Strikes Iran Nuclear Sites

On June 22, US B‑2 stealth bombers and Tomahawk missiles struck Iran’s major nuclear infrastructure in what the Pentagon dubbed Operation Midnight Hammer. Intelligence confirmed significant damage to Iran’s nuclear assets. Tehran, while downplaying the losses, accused the US of an act of war.

According to this CBS News report, Pentagon officials confirmed that B‑2 bombers carried out high-precision strikes aimed at disabling Iran’s uranium enrichment capabilities.

This unprecedented military strike significantly heightened tensions, drawing in global concern over retaliation and energy stability.

Iran’s Retaliation and Strait of Hormuz Closure Threat

Iran swiftly activated its anti-access/area denial (A2/AD) capabilities, laying naval mines and repositioning missile systems along the Strait of Hormuz—through which nearly 20% of global oil shipments pass daily.

Tehran warned that any further aggression could lead to full closure of the strait, risking global energy supply chains.

Market Fallout: Oil Prices, Stocks, and Safe Havens

🔥 Oil Prices Surge

Following the airstrikes and Iranian threats, crude oil futures soared over 10%, marking the biggest single-day spike since early 2023. The risk of strait closure and further escalation drove panic buying.

📉 Stocks Tumble

- The Dow Jones fell 1.8%, while the S&P 500 shed 0.7%.

- European airline shares (Lufthansa, KLM, EasyJet) plunged 3–5% as carriers rerouted to avoid airspace near the Persian Gulf.

- Investors showed signs of uncertainty over how the US Iran bombing stock impact might evolve.

🛡️ Safe Havens Rally

- Gold rose over 1% amid flight to safety.

- US Treasuries rallied, driving yields lower.

- The US dollar and oil-linked currencies like the Canadian dollar surged.

🔄 Crypto & Bonds

- Bitcoin dropped below $103,000 as risk assets faced selling pressure.

- Bonds saw strong demand amid risk-off sentiment.

For a deeper look at how conflict-driven volatility shapes crypto and equity reactions, read our Crypto Market Update – May 2025.

Ripple Effects on Global Trade

The Strait of Hormuz remains the world’s most critical oil chokepoint. A potential disruption could:

- Spike energy and shipping insurance costs.

- Reroute global shipping, increasing delivery delays.

- Interrupt supply chains in manufacturing, transport, and energy-heavy sectors.

Strategic Implications for the Middle East

🛡️ Military & Tactical Responses

- Iran’s missile and mine deployments showcase its A2/AD strategy.

- Israel’s use of autonomous drones and cyber-attacks highlights evolving hybrid warfare.

🏛️ Political & Diplomatic Ramifications

- Iran withdrew from backchannel nuclear negotiations with the US.

- Pressure mounted on UN Security Council to mediate or act.

🌍 Global Security Shifts

- US allies ramped up naval presence in the Persian Gulf.

- China and EU urged de-escalation, fearing oil dependency vulnerabilities.

What Comes Next

- Military Posturing: More US and allied naval deployments expected.

- Market Volatility: Oil prices and equities likely to remain unstable.

- Diplomacy or Escalation: Potential for fresh talks or further attacks.

- Energy Diversification: Countries may accelerate alternative oil sourcing.

Final Takeaway

The combined impact of US strikes on Iran nuclear sites, the looming Strait of Hormuz closure, and Iran’s retaliation over oil prices has thrown global markets into turmoil. The sharp spike in crude, investor retreat into safe havens, and widespread stock sell-offs are a clear sign of how vulnerable global economies remain to geopolitical disruption.

For energy traders, the situation marks a turning point. As the US Iran Strait of Hormuz oil stocks crisis deepens, even a short-term blockade could tighten supply, inflate prices, and disrupt downstream sectors reliant on oil stability. The aggressive posture of Operation Midnight Hammer markets has rattled investor confidence, with many unsure how long volatility will persist.

Meanwhile, defence and energy stocks have emerged as outliers—benefiting from risk hedging and speculative momentum. Yet, the broader concern lies in escalation: Will Tehran retaliate further? Could Israel re-enter with expanded strikes? And how will China, Russia, and the Gulf states respond?

Whether this becomes a prolonged conflict or a brief flashpoint, the US Iran bombing stock impact is already reshaping capital flows. For now, global markets remain hostage to political brinkmanship in the Middle East—and any misstep could send Iran retaliation oil prices even higher in the weeks to come.