Now Reading: XRP to $10? Ripple Price 2025 Outlook, ISO 20022 Surge & Brad’s Bold Plans

-

01

XRP to $10? Ripple Price 2025 Outlook, ISO 20022 Surge & Brad’s Bold Plans

XRP to $10? Ripple Price 2025 Outlook, ISO 20022 Surge & Brad’s Bold Plans

Ripple Price in 2025: XRP, the cryptocurrency of Ripple Labs, is making headlines in 2025 – and for good reason. The ripple price has surged to its highest levels in years, recently trading around $2.30 USD with a market cap near $135 billioncoinmarketcap.com. This bullish momentum comes on the heels of several game-changing developments: Ripple’s partial court victory over the SEC, growing adoption of the ISO 20022 standard (and even the FedNow instant payments network), and renewed confidence from CEO Brad Garlinghouse with bold plans for the company’s future. With XRP more than quadrupling since late 2024, many investors are asking the big question – can Ripple’s XRP hit $10 soon?

In this comprehensive guide, we’ll break down Ripple’s recent news, price trajectory, technology, and partnerships to assess whether that ambitious Ripple price target is on the horizon. We’ll also explore Ripple’s background, the XRP Ledger, major banking partnerships (like Bank of America and Santander), XRP’s Liquidity Hub, ISO 20022 integration, and what sets Ripple apart from other crypto projects. Let’s dive in!

2025 Ripple Price Surge & SEC Case Victory

Illustration of cryptocurrency tokens, including XRP – representing the recent ripple price rally.

The year 2025 has seen XRP’s price skyrocket, making it one of the top-performing major cryptos. Ripple’s legal saga with the U.S. SEC finally reached a resolution in early 2025, removing a huge cloud of uncertainty. Ripple Labs settled with the SEC in March 2025, agreeing to pay a reduced $50 million fine with no admission of wrongdoingreuters.comreuters.com. In a major win for Ripple, the SEC also dropped its appeal of the 2023 court decision that XRP is not a security when sold on exchangesreuters.com. This outcome provided regulatory clarity in the U.S., prompting many exchanges to relist XRP and giving institutional investors greater confidence (a key driver for the ripple crypto market).

Price Momentum: Following the SEC case victory, XRP’s price rallied dramatically. By May 2025, Ripple price USD values were hovering around the mid-$2 rangecoinmarketcap.com – levels not seen since early 2018. XRP briefly dipped to about $2.26 during a market pullback on May 25, 2025, but quickly rebounded, showing resiliencefinancemagnates.com. Overall, XRP has gained over 300%+ in the past 6 months, far outpacing Bitcoin and Ethereum in the same period. This strong performance has elevated XRP to the #4 cryptocurrency by market cap (trailing only Bitcoin, Ethereum, and Tether)reuters.com. Positive sentiment is soaring, with many attributing XRP’s strength to Ripple’s improving regulatory position and technical advancements.

Brad Garlinghouse’s Take: Ripple’s CEO, Brad Garlinghouse, heralded the end of the SEC battle as a new chapter for Ripple. Rather than rushing into an IPO, Garlinghouse has bold plans to expand Ripple through strategic acquisitions and global growth. In a May 2025 interview, he confirmed that Ripple is focusing on acquiring complementary companies (core blockchain infrastructure players) instead of pursuing an immediate IPOthecryptobasic.comthecryptobasic.com. This signals that Ripple is doubling down on building out its ecosystem and technology – a strategy that could indirectly boost XRP’s utility and price in the long run. (Notably, pre-IPO investment platforms like Linqto have attracted private investors to Ripple equity, anticipating a future IPO. But for now, Brad is prioritizing growth over going public.)

In short, 2025 has kicked off with major wins for Ripple: a surging Ripple coin price, a legal green light in the U.S., and an ambitious roadmap from its leadership. Next, we’ll look at how global payment standards and banking initiatives like ISO 20022 and FedNow are creating new tailwinds for Ripple’s adoption.

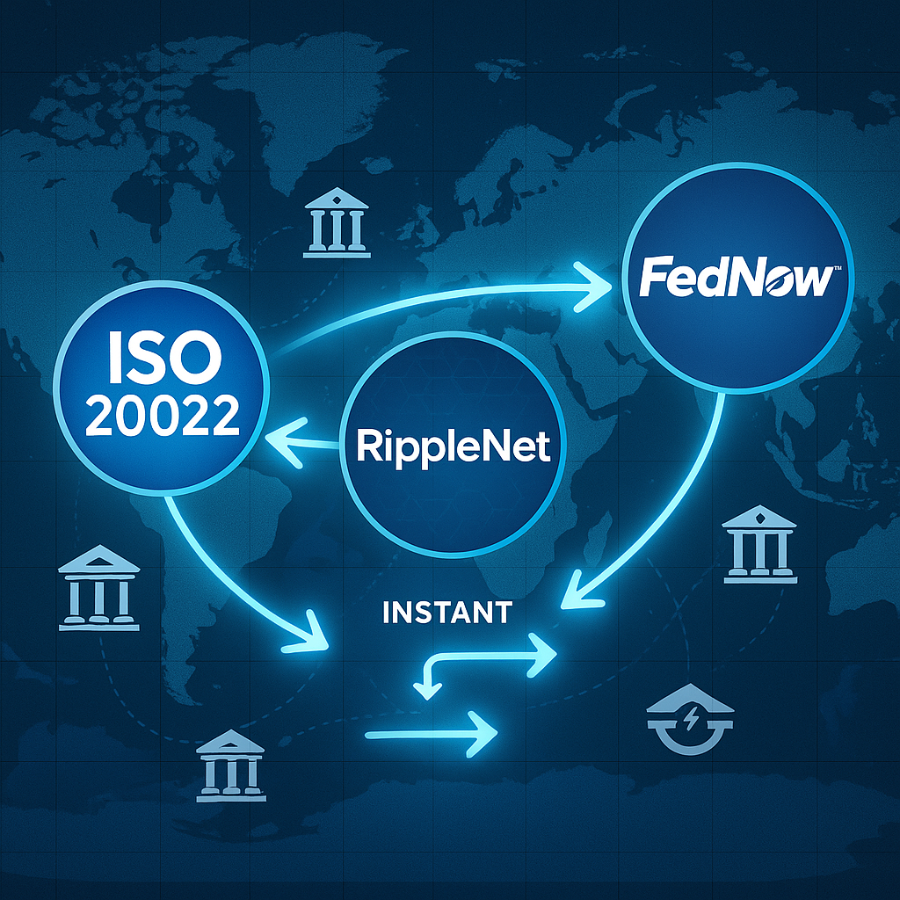

ISO 20022 & FedNow: New Tailwinds for Ripple

One of Ripple’s biggest advantages is its alignment with emerging global payment standards. ISO 20022, a new messaging format for payments, is being adopted worldwide – and Ripple has been ahead of the curve here. In fact, RippleNet has been ISO 20022-compliant from the startripple.com. Ripple was the first blockchain/DLT-focused company to join the ISO 20022 standards body back in 2020ripple.com, helping shape modern payment protocols. This foresight is paying off in 2025 as ISO 20022 becomes the dominant standard for banks and payment systems (projected to support 80%+ of global high-value transactions by 2025binance.com).

So what does this mean for XRP? It means banks can integrate Ripple’s technology more easily into their existing systems. ISO 20022 provides a common language for payment data, and Ripple’s compatibility lowers friction for banks that want faster, cheaper cross-border transfers. In March 2025, for example, the U.S. Fed is upgrading Fedwire (its interbank settlement system) to ISO 20022, and the Federal Reserve’s FedNow instant payments service (launched mid-2023) also uses ISO 20022 messagingmem.onefpa.orgmem.onefpa.org. While FedNow doesn’t directly use XRP, it underscores a broader trend: the banking world is moving toward real-time, 24/7 payments with rich data standards. Ripple is uniquely positioned to plug into this new infrastructure, offering bridge currency capabilities that traditional systems lack.

Analysts note that Ripple’s ISO 20022 readiness gives XRP a strategic edge in the coming cross-border payments boombinance.com. As ISO 20022 networks handle trillions in daily transactions, XRP’s interoperability with these systems could make it a preferred solution for real-time settlementbinance.com. In other words, banks and fintechs looking to modernize may find Ripple (XRP) an attractive option for moving money across borders seamlessly, complementing initiatives like FedNow. This alignment with international standards is a key reason the ripple cryptocurrency is seen as more “institution-friendly” compared to many other crypto coins.

Beyond standards, central bank digital currency (CBDC) projects are another tailwind. Ripple has engaged with several central banks (e.g. Bhutan, Palau, UK pilots) to test CBDCs on the XRP Ledger. Success in these trials could further cement Ripple’s role in the plumbing of next-gen finance. All these developments strengthen the narrative that Ripple is bridging the gap between crypto and traditional finance. It’s no wonder speculation is mounting that XRP’s price could reach new heights in this favorable environment – possibly even that $10 target.

XRP Price Predictions: Path to $10?

With XRP’s impressive rally in 2025, the crypto community and market analysts are buzzing about how high the Ripple coin price could go. The number “$10” has become a hot topic on social media and in trading circles – roughly another 4x gain from current levels. Is such a leap realistic? Let’s examine the predictions:

- Bullish Analyst Targets: Some experts do see XRP climbing toward the $8–$10 range relatively soon. For instance, a recent technical analysis highlighted historical patterns suggesting XRP could rocket to around $8 in the medium termfinancemagnates.com. Other forecasters have laid out scenarios where continued institutional adoption (like XRP ETFs approval and bank usage) might propel the price even higher. In one bold case, a veteran trader projected a potential 1,000% surge (which would put XRP well above $10) if certain bullish conditions alignthecryptobasic.comthecryptobasic.com. While such extreme predictions should be taken with a grain of salt, they underscore the optimism around Ripple right now.

- $5–$15 Range in Short Term: According to a detailed research forecast, XRP could reach $5–$15 in the short term, based on rising demand from institutional use and Ripple’s recent moves (like acquiring a prime brokerage to boost liquidity)binance.combinance.com. The higher end of that range ($10+ per XRP) would likely require a combination of factors: broad crypto market strength, new partnerships, and perhaps another catalyst like a major payment network integrating XRP. It’s worth noting XRP did hit an all-time high of ~$3.84 back in January 2018, so $10 would be uncharted territory – but not inconceivable if adoption explodes.

- Moderate & Bearish Views: Not everyone is convinced of a rapid climb. Some analysts maintain a conservative outlook, expecting XRP to trade between roughly $1.80 and $5 through 2025 absent further major newsbitpanda.com. And bearish scenarios point out that if regulatory or technical setbacks occur, XRP could retrace below $1 againbitpanda.com. For context, prior to the recent run-up, ripple price today would have seemed high – XRP spent much of 2020–2022 under $0.50 during the lawsuit limbo. Thus, a $10 XRP would represent a massive turnaround, contingent on near-flawless execution by Ripple and strong crypto market conditions.

So will XRP reach $10? It’s certainly possible in a bullish-case 2025, especially with clear skies legally and increasing adoption. Achieving that would put XRP’s market cap around $500 billion (assuming roughly 50B XRP circulation) – implying it would need to siphon significant capital from other assets or bring in a wave of new money. Ripple’s partnerships, tech upgrades, and expanding use case will be critical factors to watch. In the next sections, we delve into exactly those aspects: what Ripple is doing to drive real-world usage of XRP and transform global payments, which ultimately underpins any long-term price growth.

(For a broader context on the crypto market’s performance in 2025 – including Bitcoin, Ethereum, and other altcoins – check out our internal Crypto Market Update (May 2025) for the latest insights.)

Ripple’s Background & Global Role

What exactly is Ripple and why is it so pivotal in global finance? Ripple is both a company (Ripple Labs) and a platform, created in 2012 with the goal of revolutionizing cross-border payments. In traditional banking, sending money internationally is slow and costly, relying on a web of correspondent banks (think SWIFT messages and multiple currency conversions). Ripple set out to change that by using blockchain technology and a digital asset (XRP) as a bridge currency. This allows value to move instantly, at almost zero cost, between any two currencies or parties. Essentially, Ripple aims to be the internet of value, enabling money to flow as freely as information does today.

Over the past decade, Ripple has positioned itself as a partner to banks and payment providers rather than a disruptor. It developed RippleNet, an enterprise payment network that banks can join to transact with each other directly in real-time. RippleNet can function with just fiat currencies, but its secret sauce is the use of XRP (the Ripple coin) for liquidity through a service called On-Demand Liquidity (more on ODL shortly). By bridging transactions with XRP, banks don’t need pre-funded foreign accounts (nostro/vostro), dramatically reducing costs and freeing up capital. This value proposition has attracted 300+ financial institutions to RippleNet over the years, including household names in banking, remittances, and fintech.

Ripple’s role in global finance continues to grow. It’s not just a crypto project; it’s a fintech innovator regularly mentioned alongside the likes of SWIFT in discussions of cross-border payments. The World Economic Forum (WEF) has lauded Ripple as a leader in blockchain payments, and central banks from Bhutan to Saudi Arabia have piloted Ripple’s technology for possible digital currency implementation21shares.com21shares.com. This mainstream approach (working with regulators and institutions) sets Ripple apart in the crypto world. It also explains why developments like ISO 20022 adoption, FedNow, and the SEC case outcome are so crucial – Ripple’s strategy is to integrate with the existing financial system, making it faster and more efficient. When that system moves in Ripple’s direction (e.g. demanding real-time, data-rich payments), Ripple stands to benefit immensely.

In summary, Ripple Labs has evolved from a startup with a bold idea into a major player at the intersection of crypto and banking. By building credibility and forging alliances, Ripple has laid the groundwork for XRP to potentially become a backbone of cross-border value transfer. Next, we’ll look under the hood at how Ripple’s technology actually works – specifically, the RippleNet network and the XRP Ledger blockchain.

RippleNet & XRP Ledger: How Ripple’s Tech Works

At the heart of Ripple’s ecosystem are two key components: RippleNet and the XRP Ledger (XRPL). Understanding these gives insight into Ripple cryptocurrency’s unique strengths.

- RippleNet: This is Ripple’s global payment network used by banks, payment providers, and remittance companies. It’s essentially a set of software solutions (like xCurrent, xRapid/ODL, and xVia in earlier terminology) that enable participants to send money across borders instantly. Think of RippleNet as a next-gen SWIFT – but instead of just messaging, it actually moves value. RippleNet allows fiat payments to settle in seconds and provides end-to-end tracking. A crucial feature is On-Demand Liquidity (ODL), which leverages XRP as a bridge asset. In ODL, if Bank A in the US wants to send $1 million to Bank B in Mexico, RippleNet can convert USD to XRP, send XRP to the Mexican partner, and convert XRP to Mexican pesos – all in one flow, in secondscointelegraph.comcointelegraph.com. This means no pre-funded peso accounts needed. ODL has been a game-changer, saving costs on currency exchange and freeing up billions in capital for institutions. Major remittance firms like MoneyGram (previously) and fintechs like Bitso have used ODL for corridors like US-Mexico, and Ripple is expanding this service globally.

- XRP Ledger (XRPL): The XRPL is a decentralized blockchain network that launched in 2012 (originally called Ripple Consensus Ledger). It’s an open-source ledger maintained by a network of validators (which include universities, institutions, and Ripple itself). XRPL is known for its speed and efficiency: it can handle ~1,500 transactions per second with settlements in 3-5 seconds, and transaction fees are fractions of a cent21shares.com21shares.com. Unlike Bitcoin’s proof-of-work or Ethereum’s staking, XRPL uses a unique consensus algorithm (a form of federated Byzantine agreement) with a trusted node list to validate transactions – resulting in low energy use and high throughput. The XRP cryptocurrency is the native asset of the ledger, used to pay transaction fees (which are burned, making XRP supply slightly deflationary over time21shares.com) and as a bridge currency in the built-in decentralized exchange. Yes, XRPL was one of the first blockchains to have a built-in DEX (decentralized exchange) where users can issue and trade tokens. This means you can trade, say, USD for EUR or any asset on the ledger directly, with XRP often acting as the intermediary for liquidity21shares.com21shares.com. XRPL also supports advanced features like escrowed payments, checks, and even NFTs and smart contract functionality through sidechains, making it versatile for developers.

Together, RippleNet and XRPL form a hybrid system. RippleNet (with ODL) taps the XRPL and XRP to settle transactions. This design offers the best of both worlds: a fast, public digital asset (XRP) for liquidity and a secure enterprise network (RippleNet) with privacy and compliance features banks need. The result is a frictionless experience where an end user might not even realize crypto is involved – they just see a near-instant transfer at low cost. 🏦💱

Key Technical Advantages of Ripple (XRP): (Why banks and businesses find value in it)

- Speed & Scalability: ~3 second settlements, 1,500+ TPS capacity, making it enterprise-ready for high-volume use21shares.com.

- Low Cost: Negligible fees (often <$0.01 per transaction), no expensive mining costs – ideal for micro-transactions and large payments alike21shares.com.

- Certainty: Transactions are final (no chargebacks) and XRP’s ledger has proven reliable over 10+ years. Consensus design avoids double-spend and 51% attacks, with finality in seconds.

- Built-in DEX and Tokenization: XRPL can tokenize any asset (fiat, commodities, stocks, etc.) and has a native exchange, enabling seamless multi-currency transactions on one ledger21shares.com.

- Environmentally Friendly: No mining means minimal energy usage – a green crypto relative to Bitcoin, aligning with banks’ ESG goals.

- Controlled Supply: 100 billion XRP were created at inception (no inflation). Ripple Labs holds a portion in escrow and releases it on a fixed schedule, providing transparency and preventing large dumps21shares.com21shares.com. This setup addresses concerns about supply shock and centralization.

By leveraging these features, Ripple offers a compelling solution for modern finance. It’s not just theory either – Ripple’s tech is battle-tested, with billions of dollars in transactions already processed via RippleNet and XRPL. In the next section, we’ll highlight some of Ripple’s major partnerships and real-world adoption, which help illustrate how this technology is being used today.

Major Partnerships (Bank of America, Santander & More)

Ripple’s strategy of collaborating with established financial players has led to an impressive roster of partnerships and customers over the years. These alliances give Ripple a global reach and lend credibility to its solutions. Here are a few of the standout partnerships and use cases:

- Santander & American Express: One of Ripple’s early successes was Santander, a European banking giant. Santander launched a Ripple-powered payments app called One Pay FX in 2018, allowing same-day international transfers across 19 countries. Additionally, American Express partnered with Santander to use RippleNet for cross-border payments from the U.S. to the U.K., making transactions for Amex’s business clients faster and traceable21shares.com. This was a big vote of confidence – a top U.S. credit card company and a major bank leveraging Ripple for real transfers.

- Bank of America: BoA, one of the largest banks in the U.S., has been quietly associated with Ripple for years. In 2020, Bank of America’s name appeared as a member of RippleNet’s advisory board, and in 2021 an executive praised Ripple’s ability to integrate with banking systems. By 2025, Bank of America is considered a high-profile Ripple partner that has explored using Ripple’s blockchain for settlements and treasury flows21shares.com. While neither BoA nor Ripple make loud public announcements about it, the relationship indicates serious interest from big banks in Ripple’s tech.

- Linqto & Investors: Outside of banking, platforms like Linqto have allowed accredited investors to buy equity in Ripple Labs (the company) in recent years. This pre-IPO investment interest shows that many believe in Ripple’s long-term success. Linqto has reported Ripple as one of its most popular offerings, suggesting strong demand to own a piece of Ripple before any future IPO. (Ripple’s valuation has been estimated in the $10B-$15B range in secondary markets.) This isn’t a partnership per se, but it’s worth noting as part of Ripple’s ecosystem of support.

- Other Banks and Providers: Ripple has a long list of financial institutions on RippleNet across regions. Asia-Pacific has seen heavy adoption – for example, SBI Holdings in Japan is a key partner (they even jointly launched SBI Ripple Asia) and drives usage of XRP for remittances in Asia. MoneyTap in Japan (a bank consortium) uses Ripple tech for domestic transfers. In the Middle East, Ripple works with banks like QNB and Saudi Arabia’s SAMA (central bank) on pilots21shares.com. In Latin America, Ripple’s partner Bitso (a crypto exchange) was instrumental in using XRP for remittances between the U.S. and Mexico21shares.com. Tranglo in Southeast Asia and Azimo in Europe/Africa have also utilized XRP for cross-border payouts. The common thread: these partners leverage Ripple to cut transfer costs and time dramatically, often passing those savings to customers.

- Central Bank Partnerships: As mentioned earlier, Ripple has engaged with central banks exploring digital currencies. The Bank of England included Ripple in its fintech accelerator in 2017. More recently, Bhutan’s central bank (RMA) is using Ripple’s CBDC solution to issue a digital Ngultrum (national currency) to increase financial inclusion21shares.com. Palau is working with Ripple to explore a USD-backed stablecoin for their economy. These projects hint at Ripple’s potential role in the plumbing of future CBDCs and national payment systems.

This broad network of partnerships shows that Ripple isn’t operating in a vacuum – it’s deeply integrated with real financial entities. As more banks and payment companies come onboard, it creates a network effect strengthening RippleNet and demand for XRP (since many corridors ultimately utilize XRP for settlement via ODL). Importantly, some partnerships use Ripple tech without XRP (just the software messaging), but with the SEC clarity now achieved, Ripple is hopeful U.S. banks will soon use XRP through ODL for extra liquidity efficiencytheblock.co. Ripple’s President Monica Long recently hinted that American banks could begin adopting ODL by late 2025, now that the legal ambiguity is resolved – a development that would be huge for XRP usage.

In summary, Ripple’s partnerships – from Bank of America to Santander, American Express, SBI, and central banks – underscore that it has one foot firmly in traditional finance and the other in crypto innovation. This dual approach could be a catalyst for XRP’s value as adoption grows.

(If you’re new to crypto and looking to buy Ripple (XRP) to potentially ride the wave, remember to use a reputable ripple exchange (like Coinbase, Kraken, or Binance) and store your XRP securely. Check out our guide on how to create a crypto wallet for tips on safeguarding your assets.)

XRP Market Cap & Liquidity Hub

As of mid-2025, XRP’s market capitalization places it among the top four cryptocurrencies globallyreuters.com. This is a remarkable feat for a coin that was mired in legal uncertainty just a year or two ago. Ripple’s market cap dominance signals the market’s belief in its longevity and utility. Let’s break down a couple of important aspects related to XRP’s market presence and liquidity:

Market Cap & Circulation: XRP’s circulating supply is about 53 billion tokens out of a 100 billion max supply. Ripple Labs (the company) holds the remaining tokens, mostly locked in an escrow system that releases 1 billion XRP monthly (with unused portions returned to escrow)21shares.com21shares.com. This mechanism provides predictability and has gradually distributed XRP into the market over time. A large market cap (over $130B now) also brings liquidity; XRP often has daily trading volumes in the billions of dollars, meaning investors can usually buy or sell sizable amounts without extreme slippage. High liquidity is crucial if XRP is to serve as a bridge currency for banks – it needs to handle institution-sized transactions. Fortunately, XRP’s trading is widespread on exchanges worldwide (though always do your due diligence on which Ripple exchange you use).

Ripple’s Liquidity Hub: In April 2023, Ripple launched a product called Liquidity Hub aimed at enterprise and institutional clientscointelegraph.com. Think of it as a crypto liquidity aggregator for businesses. Through one API, companies can access liquidity from multiple sources – exchanges, market makers, OTC desks – to buy, sell, or transfer digital assets at the best available pricescointelegraph.com. The Liquidity Hub connects to various crypto markets (Bitcoin, Ethereum, Litecoin, etc., and now likely XRP as well) and even fiat channels, allowing businesses to convert assets seamlessly. This service complements Ripple’s ODL: while ODL is about cross-border payments using XRP, Liquidity Hub is about giving institutions an easy way to manage crypto liquidity for many use cases (treasury, payments, even cryptocurrency trading for their clients).

The benefit of Liquidity Hub is that it eliminates the need for pre-funding or multiple exchange accounts – an enterprise can tap a deep pool of liquidity on demandcointelegraph.com. For example, a fintech app could use Liquidity Hub to instantly source XRP (or BTC, etc.) at optimal rates when a user needs to send a payment or when rebalancing reserves, all through one integration. By 2025, Ripple has expanded Liquidity Hub to more regions (recently moving into Brazil and Australia) and improved its features for customersbinance.combeincrypto.com. Now with the SEC case over, XRP is expected to be fully integrated into the Liquidity Hub offering (initially it was omitted due to regulatory cautioncointelegraph.com). This means banks using Liquidity Hub can seamlessly get XRP liquidity when needed, which again could bolster XRP’s usage and price (USD) stability.

ISO 20022 Integration: We discussed ISO 20022 earlier, but it’s worth reiterating in context of market infrastructure. Ripple’s inclusion in the ISO 20022 standard body means its systems (like RippleNet) are interoperable with modern banking messaging. As of 2025, many domestic payment systems and SWIFT itself have migrated to ISO 20022, and U.S. Fedwire’s switch is slated for July 2025frbservices.orginstagram.com. Ripple’s ability to slot into these systems (via APIs that speak the same language) could accelerate adoption. It’s an integration selling point: a bank doesn’t have to overhaul everything to use Ripple; Ripple works within the new standards banks are adopting anyway. This positions XRP as a logical liquidity solution in an ISO 20022 world – essentially acting as a real-time foreign exchange tool that complements the new messaging rails.

In summary, XRP’s large market cap and liquidity, combined with Ripple’s liquidity solutions and standards integration, are ushering in a new era. If Ripple can continue scaling liquidity through products like Liquidity Hub and maintain XRP’s deep order books, it will instill further confidence in using XRP for big settlement flows. Liquidity begets liquidity – the more participants see that XRP markets can handle large transactions efficiently, the more they might be willing to use it, potentially driving the ripple price higher.

Risks and What Sets Ripple Apart

No investment or technology is without risks, and despite Ripple’s many strengths, there are a few factors to watch. At the same time, Ripple and XRP have some unique qualities distinguishing them from other cryptos. Let’s examine both sides:

Potential Risks for Ripple/XRP:

- Regulatory Changes: While the SEC saga in the U.S. is largely resolved in Ripple’s favor, regulation remains a wild card globally. Different countries may classify or restrict XRP differently. Any unexpected regulatory crackdown (for example, if another major economy suddenly bans banks from using crypto) could hurt adoption. Ongoing compliance will be key; Ripple must navigate licensing, anti-money-laundering rules, and central bank approvals as it integrates with traditional finance.

- Competition (Traditional & Crypto): Ripple isn’t the only solution for cross-border payments. The incumbent SWIFT network has rolled out its own instant settlement service (SWIFT gpi) and is experimenting with CBDCs and blockchain interoperability. Stellar (XLM) is a crypto project with a similar use case to XRP (in fact, Stellar’s founder Jed McCaleb co-founded Ripple), aiming at remittances and CBDCs as well. Other platforms like Visa and JPMorgan’s Liink are also vying to modernize payments with blockchain or digital currency tech. If a big bank consortium or a government-backed network creates a widely adopted alternative, Ripple will need to stay ahead through performance and partnerships. So far, Ripple’s head start and focus give it an edge, but the race is on.

- Centralization Concerns: Critics often point out that Ripple Labs holds a large portion of XRP (even though it’s in escrow) and that the default UNL (unique node list) for validators is maintained by Ripple. This has led to a perception that XRP is more centralized than Bitcoin/Ethereum. Ripple counters that the ledger is open and many validators are independent – and the escrow locks prevent abuse of XRP supply. Nonetheless, some decentralization purists prefer other cryptos. If Ripple isn’t careful to continue decentralizing governance of the XRPL, it could face community skepticism. However, the trade-off has been greater efficiency and a clear strategic direction, which many institutions actually appreciate.

- Market Volatility: By nature, crypto prices are volatile, and XRP is no exception. Sudden market downturns (a crypto winter scenario) could drag XRP down regardless of Ripple’s progress. Investors should be prepared for swings. For instance, XRP jumped 70% in a day after the initial court ruling in July 2023, then retraced; similar turbulence could occur around news or Bitcoin’s cycles. High volatility might discourage some banks from using XRP as they prefer stable values for settlements. Ripple has tried to mitigate this (ODL transactions are so fast that exposure to XRP’s price is only a few seconds), but it’s still a point to note.

What Sets Ripple Apart:

Despite those risks, Ripple has a combination of features difficult to find elsewhere, which is why many consider it a standout project in crypto:

- Real-World Adoption: Ripple’s focus on actual use cases (cross-border payments) and securing real partners is a huge differentiator. Many crypto projects talk about future adoption; Ripple is already in use by banks and companies today. This tangible utility can support long-term value better than pure speculation-driven projects.

- Institutional Focus: From day one, Ripple targeted financial institutions, not retail crypto users. This B2B approach means Ripple built in things like compliance tools, the ability to reverse transactions for error resolution, and messaging standards integration. It’s a very different approach from, say, Bitcoin’s “be your own bank” ethos. Ripple’s cooperative strategy with the current system (instead of wanting to dismantle it) has earned it allies in high places, positioning it as a bridge between traditional finance and crypto.

- Speed and Efficiency: As discussed, XRP transactions are blazingly fast and cheap compared to Bitcoin (which can take 10+ minutes) or even Ethereum (which, despite recent upgrades, is slower and has higher fees). This makes XRP more practical for payments. For example, try buying a coffee with Bitcoin vs XRP – the XRP will confirm in seconds without high fees. This technical edge is crucial for a payments-oriented coin.

- Breadth of Vision: Ripple’s scope isn’t limited to just remittances or just one region. They are tackling everything from retail remittances, to corporate treasury, to even helping build CBDC platforms for central banks. It has multiple lines of effort (RippleNet, ODL, Liquidity Hub, XRP Ledger development, CBDC solutions). Few crypto projects have such breadth. This diversified approach means even if one avenue grows slowly (say, U.S. bank adoption is cautious), another can take off (Asian fintech usage, or CBDC tech sales). It provides resilience to the overall project.

- Community and Developers: The XRP Ledger has an active developer community and Ripple supports it through initiatives like the XRPL Grants and annual Apex Dev Summit. New features (like NFTs on XRPL, Ethereum-compatible sidechains, and smart contract functionality through hooks or sidechains) are being added, often driven by community proposals. This means XRP isn’t stagnant; it’s evolving just like Ethereum or others, but with a focus on payments. Ripple’s recent announcement of an EVM sidechain by 2025 will even allow Ethereum-based apps to port over to XRP Ledger easily21shares.com, potentially bringing DeFi and smart contracts into the Ripple ecosystem without compromising the main ledger’s efficiency.

In essence, Ripple sets itself apart by being a pragmatic and business-friendly crypto project. It’s not here to be the most decentralized or the most hyped meme coin; it’s here to solve a multi-trillion dollar problem in payments, and it’s been steadily succeeding at that. This makes XRP a unique asset – straddling the worlds of banking and blockchain.

Conclusion: Ripple’s Road Ahead

Ripple’s journey has been anything but smooth – yet here in 2025, it stands stronger than ever. XRP’s price resurgence, legal clarity in the U.S., and deepening integration into the global financial fabric all point to an exciting new chapter for Ripple. The talk of “XRP to $10” reflects the optimism that Ripple could play a pivotal role as payments go digital worldwide. While no one can predict the future with certainty, the building blocks for sustained growth are clearly visible:

- Confidence is back: The end of the SEC case removed the proverbial albatross from Ripple’s neck. This opens doors – U.S. exchanges relisting XRP, institutional investors considering XRP, and possibly U.S. banks trialing it for the first time. Regulatory clarity was huge, and Ripple seized the momentum.

- Adoption is accelerating: With ISO 20022 becoming the norm, FedNow and other real-time payment systems launching, and crypto ETFs and infrastructure going mainstream, Ripple is in the sweet spot. Banks and businesses now need solutions that Ripple happens to provide. Each new partnership or integration (whether via RippleNet, Liquidity Hub, or XRPL) potentially brings in more volume for XRP.

- Innovation continues: Brad Garlinghouse and team aren’t resting. They’re expanding via acquisitions, improving the technology, and perhaps even eyeing a future IPO when the time is right. Ripple’s vision of the Internet of Value is unfolding bit by bit – from remittances to enterprise crypto liquidity to central bank digital currencies. If Ripple keeps executing, it could be as transformative to value transfer as companies like Visa were to card payments.

Of course, challenges will arise – be it competition, market swings, or technical hurdles. Crypto is a fast-moving industry and Ripple must remain agile. But with over a decade of experience, a war chest of XRP and cash, and a clear mission, Ripple is better equipped than most to navigate ahead.

For XRP holders and enthusiasts, the path to $10 will depend on a confluence of factors going right. It’s not guaranteed, but as we’ve discussed, a credible case can be made for significant upside if adoption continues on its current trajectory. At the same time, prudent investors will keep an eye on risks and not invest more than they can afford to lose in this volatile space.

Bottom Line: Ripple has proven its resilience and value proposition in 2025. The ripple price reflects a renewed belief that XRP can be more than just another altcoin – it can be the backbone of a new era in payments. Whether or not $10 XRP happens soon, Ripple’s progress indicates that its long-term prospects remain bright.

As always in crypto, do your own research and stay updated. Ripple’s road ahead will certainly be newsworthy. And who knows – if things go Ripple’s way, that oft-cited moonshot figure of $10 may not be so far-fetched after all.

Frequently Asked Questions (FAQ)

Q: Can Ripple’s XRP really reach $10?

A: It’s possible, but not guaranteed. Hitting $10 would likely require continued bullish momentum, major increases in adoption, and a strong overall crypto market. Optimistic analysts point to factors like new XRP ETFs, more banks using XRP for liquidity, and broader crypto acceptance as reasons XRP could approach $10 in the medium term. In fact, some forecasts see XRP in the $5–$10 range by 2025’s end under favorable conditionsbitpanda.com. However, more conservative predictions have XRP closer to $3–$5. Reaching $10 would mean roughly a ~$500 billion market cap, so Ripple would need to keep delivering big wins. It’s not impossible – especially now that the SEC barrier is removed – but investors should temper expectations and watch how Ripple’s adoption progresses.

Q: What was the outcome of the Ripple vs. SEC lawsuit?

A: The long-running SEC lawsuit against Ripple Labs concluded with a partial victory for Ripple. In July 2023, a court ruled that XRP is not a security when sold on public exchanges, though sales of XRP directly to institutional investors did violate securities laws21shares.com. The SEC initially planned to appeal the part of the ruling favoring Ripple, but in March 2025 Ripple announced a settlement with the SEC. Ripple agreed to pay a $50 million fine (significantly reduced from an earlier penalty) and the SEC in turn dropped its remaining claimsreuters.comreuters.com. Importantly, Ripple admitted no wrongdoing in the settlement. This outcome gave regulatory clarity that XRP itself is not considered a security in the U.S., paving the way for exchanges to relist XRP and institutions to use it without legal fears. The end of the case was a huge relief for Ripple and removed a major uncertainty that had hung over the ripple cryptocurrency for years.

Q: What is ISO 20022 and how does it relate to Ripple?

A: ISO 20022 is a global standard for financial messaging – basically a common format for payment data that banks and systems worldwide are adopting. It allows richer information in payment messages and better interoperability between different payment networks. By 2025, ISO 20022 has become the dominant standard for cross-border payments (SWIFT is migrating to it, and many central payment systems use it). Ripple recognized its importance early on: RippleNet has been aligned with ISO 20022 from the beginningripple.com. In 2020, Ripple even became the first blockchain company on the ISO 20022 standards bodyripple.com. This means Ripple helps shape the standard and ensures its products fit the new requirements. The benefit for Ripple is that banks can integrate Ripple’s tech more easily if it “speaks” the same language (ISO 20022) as their other systems. For example, the U.S. FedNow service uses ISO 20022 messagesmem.onefpa.org – while FedNow doesn’t use XRP, the broader shift to real-time payments with ISO 20022 is complementary to Ripple’s offerings. In short, ISO 20022 is part of the plumbing of modern finance, and Ripple is compatible with it, which is a big plus when convincing banks and regulators.

Q: What is Ripple’s Liquidity Hub?

A: Liquidity Hub is a product Ripple launched for businesses that need to manage and source cryptocurrency liquidity. It’s essentially a B2B crypto liquidity platform. Through one interface, a company can access multiple exchanges and liquidity providers to buy, sell, or trade crypto assets at the best prices availablecointelegraph.com. Imagine an exchange aggregator or a “kayak.com for crypto liquidity” specifically for enterprise use. For instance, if a fintech app needs to instantly convert $100,000 into Bitcoin or XRP for a customer, Liquidity Hub will find the optimal rate across different markets and execute the trade, all behind the scenes. It supports assets like BTC, ETH, LTC and, following the SEC clarity, now XRP as well. The goal is to save businesses the trouble of holding inventories of crypto or dealing with multiple exchange integrations. It even handles things like optimizing prices and reducing transaction fees for high-volume transactionscointelegraph.com. Ripple’s Liquidity Hub complements its payment products – while ODL focuses on cross-border payments using XRP, Liquidity Hub is a more general service for any kind of digital asset liquidity needs (treasury operations, crypto payment processing, etc.). By offering this, Ripple is aiming to be a one-stop shop for institutions bridging between crypto and fiat. It’s also a revenue stream beyond XRP sales – customers likely pay fees for using the hub. Overall, Liquidity Hub strengthens the Ripple ecosystem by broadening its appeal to businesses that want crypto capabilities.

Q: How is Ripple’s XRP different from Bitcoin and other cryptos?

A: There are several key differences:

- Purpose: Bitcoin was created as a decentralized digital currency/store of value, aiming to be an alternative to fiat money. XRP was created mainly to facilitate efficient payments and transfers, particularly for banks. Ripple’s focus is on utility for the financial industry, whereas Bitcoin’s focus is more on being censorship-resistant money and an investment asset.

- Consensus Mechanism: Bitcoin uses Proof-of-Work (mining), which is energy-intensive and can process about 5-7 transactions per second. XRP uses a consensus algorithm with validators (no mining, no staking needed), which is far faster (1500+ TPS) and consumes minimal energy21shares.com. This makes XRP more suitable for high-volume transactions like global payments.

- Supply & Tokenomics: Bitcoin has a capped supply of 21 million coins and they are released via mining over time (fully mined by ~2140). XRP had 100 billion tokens created at the start, with no ongoing mining. A large portion of XRP was (and some still is) held by Ripple Labs. Ripple’s escrow system releases XRP on a schedule to ensure a predictable supply and to mitigate concerns of dumping21shares.com. This is a more centralized distribution approach compared to Bitcoin’s fully decentralized mining distribution.

- Decentralization: Bitcoin is often considered more decentralized in that no single company controls it, and its development is open-source and community-driven. XRP’s development and ecosystem have significant input from Ripple, the company. While the XRP Ledger is technically decentralized (anyone can run a validator and the network continues even if Ripple disappears), Ripple’s influence is substantial. This leads to debates – proponents say this managed decentralization is why XRP is enterprise-grade (it has clear governance and improvements), while critics prefer Bitcoin’s more leaderless system.

- Use Cases: XRP’s primary use case is as a bridge currency for cross-border payments and liquidity (via RippleNet/ODL). Bitcoin’s primary use case is as digital gold or a long-term investment, and as a way to transact outside of government systems. Other cryptos like Ethereum focus on smart contracts and decentralized applications. XRP is more narrowly focused on payments and banking, which it does very well, but it’s not Turing-complete like Ethereum for complex smart contracts (though sidechains are bringing smart contracts to XRPL). Each crypto has its niche – Ripple’s niche is the payments/settlements layer for the financial world.

In summary, Ripple’s XRP is built for speed and cost-efficiency in transactions, with a company (Ripple) actively driving its adoption in banking. Bitcoin pioneered the idea of cryptocurrency and prioritizes decentralization and security over speed. Both can coexist, serving different purposes in the evolving digital economy.

Pingback: 🚨 Scam Alert 2025: List of Fake Crypto Exchanges You Must Avoid (Shocking List)